Finding Balance: Navigating Your 401(k) in a Stock-Driven World

Explore practical tips for a balanced 401(k) in a stock-focused market.

Have you ever peeked into your 401(k) and felt like you’re hanging by a thread over the stock market’s ever-swinging pendulum? You're not alone. Many are grappling with the reality that their retirement funds are heavily linked to stock performances. But fear not—finding balance is possible!

Why is Your 401(k) So Stock-Heavy?

The rise in 401(k) plans being invested heavily in stocks isn’t accidental. Historically, stocks have offered some of the highest returns, making them attractive to employers and fund managers seeking growth. However, the pendulum swing comes with its own set of risks, predominantly market volatility.

How Can You Manage Risk?

Let's talk about a friend, Jamie, who found herself in a similar predicament. She watched the market's ups and downs play out like a suspenseful thriller, gripping her 401(k) close to her chest. So, what did Jamie do?

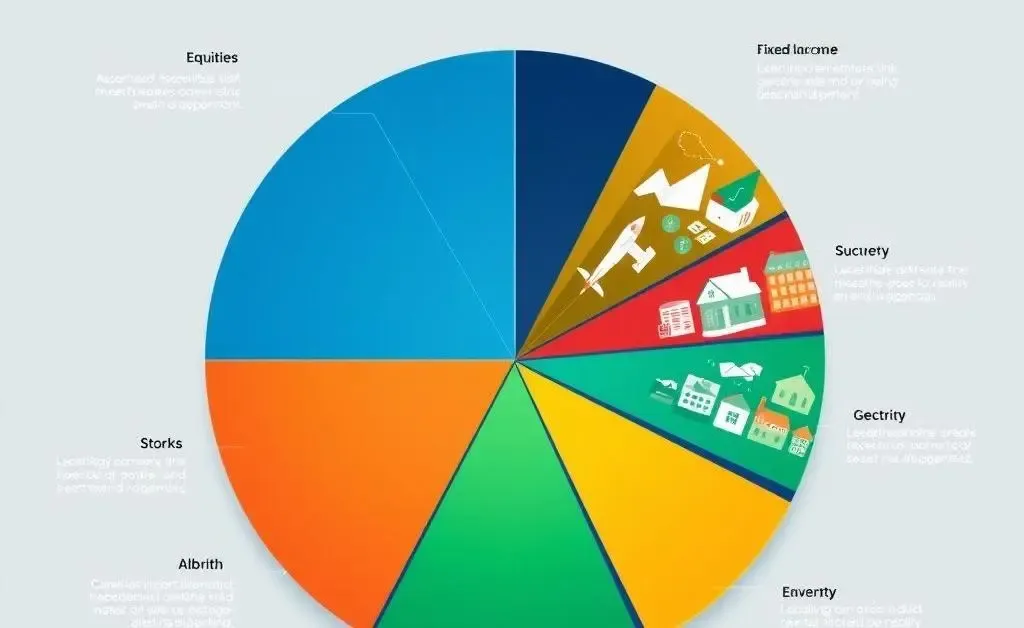

- She diversified her portfolio—spreading risk across stocks, bonds, and even some real estate options.

- She consulted with financial advisors to tailor her fund allocations based on her tolerance for risk and retirement timeline.

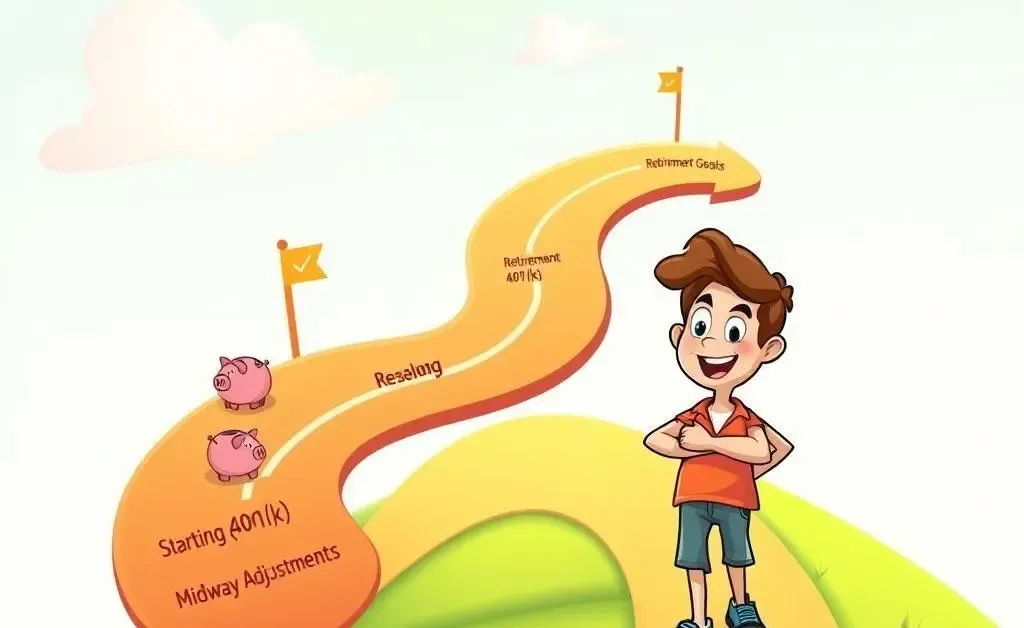

- She regularly reviewed and rebalanced her portfolio to adapt to changing markets.

Should You Stay In or Opt-Out?

While ditching stocks completely might sound tempting, consider the long-term growth potential they offer. Instead, focus on creating a safety net for your portfolio. Here’s how:

Mix in safer, stable investments with those higher-risk stocks. Sometimes, it's about tweaking your allocations regularly. Listen to the market, but also listen to what feels right for you financially.

Final Thoughts

Like Jamie, being proactive about managing your 401(k) could save you a lot of worry down the line. Reassess your strategy regularly, stay informed, and prioritize financial health. What strategies have you found work best for your own investments? Share your insights and let’s navigate this journey together.