Finding Calm in Financial Planning: Your Guide to Budgets and Confidence

Discover how to build financial confidence with simple budgeting tools.

Hey friend, have you ever sat down to look at your finances and felt your anxiety spike? I know the feeling all too well. We all want financial stability, but the road to get there can feel overwhelming. Today, let’s talk about practical budgeting tips and how they build confidence in your financial planning, so you can wave goodbye to those worries.

Why Is Financial Confidence Important?

First off, why is confidence in financial decisions such a game changer? Well, financial confidence means making your money work for you—they’ll let you achieve long-term goals while enjoying peace of mind. When you feel secure in your budgeting and investments, it’s like having a personal cheerleader keeping you motivated.

Budgeting Like a Pro

Begin with simple steps that can be transformative. Trust me, setting a budget doesn’t mean locking away your money and throwing away the key! It’s like taking a map with you—guiding your expenses and savings so you won’t get lost later.

- Track Your Spending: Make it a habit to jot down expenses, whether it’s through an app or good ol’ paper and pen. You might be surprised to see where your money actually goes.

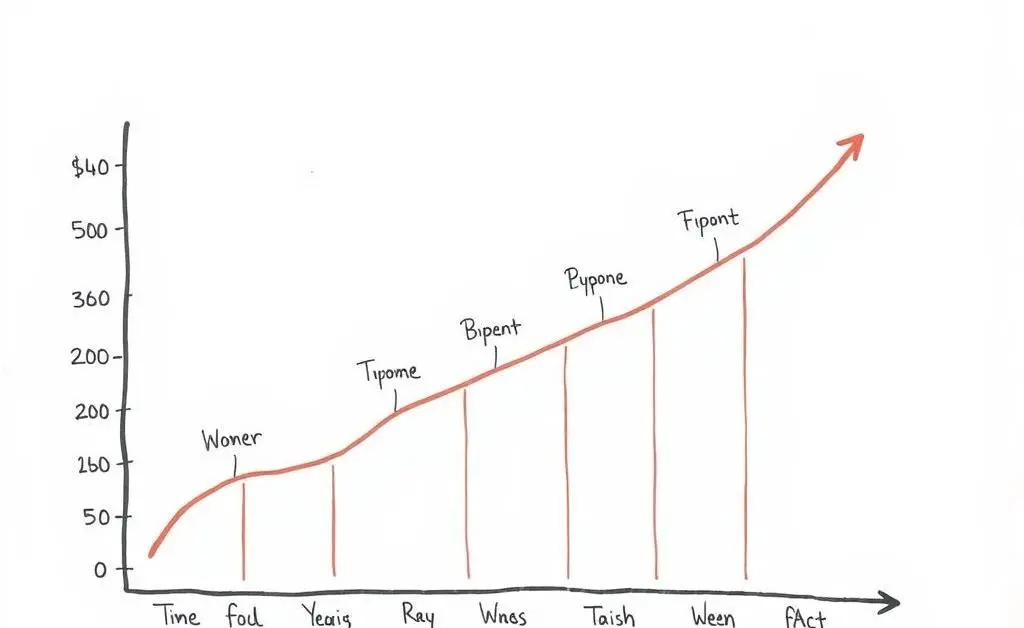

- Set Realistic Goals: Break down your dreams into actionable plans. Want to save for a trip, new apartment, or emergency fund? Start small and watch your savings grow!

From Budgets to Investments

With budgeting in place, you’ll start seeing extra funds popping up, which is when choosing investments comes into play. Just like learning to ride a bike, investing gets easier (and less scary) the more you do it.

Building Toward Financial Milestones

Think of financial planning as a series of milestones rather than a drag. Celebrate small wins—paid off a credit card or finally saved enough for that emergency fund? Go you!

Each milestone boosts your confidence, making every step after much simpler. It becomes a domino effect of self-affirmation and empowerment.

Final Thoughts

If you take away one thing from our chat today, let it be this: confidence in finance isn’t reserved for experts; it’s for anyone determined to take charge. As you create your ideal budget and worry-free investment portfolio, you’re not just building wealth—you’re constructing a legacy of security and peace of mind.

How do you currently tackle financial planning? Do you have a favorite strategy or tip? Let’s keep the conversation going!