Finding Financial Confidence: The Power of Credit Unions and Personal Finance Strategies

Discover how credit unions can boost your financial confidence with budgeting tips and investment strategies.

Have you ever felt overwhelmed by the world of personal finance? Trust me, you're not alone. Every day, many of us grapple with the complexities of managing money, saving effectively, and making smart investment choices. But let me share something that has made a significant difference for countless individuals: credit unions.

Why Consider a Credit Union?

Credit unions might seem like a niche market in the vast financial industry, but they offer a unique edge, particularly in fostering a community-focused approach to money management. They are not-for-profit institutions. This means they can potentially offer better interest rates and lower fees than traditional banks—an excellent way to enhance your savings and financial confidence.

Budgeting: Your Financial GPS

Budgeting isn't just about restricting your expenses; it's about gaining control over your financial journey. Think of it as your personal GPS guiding you through the ups and downs of your financial landscape. It helps prioritize expenses, save for emergencies, and even allocate money towards fun activities guilt-free!

Invest With Confidence, Not Uncertainty

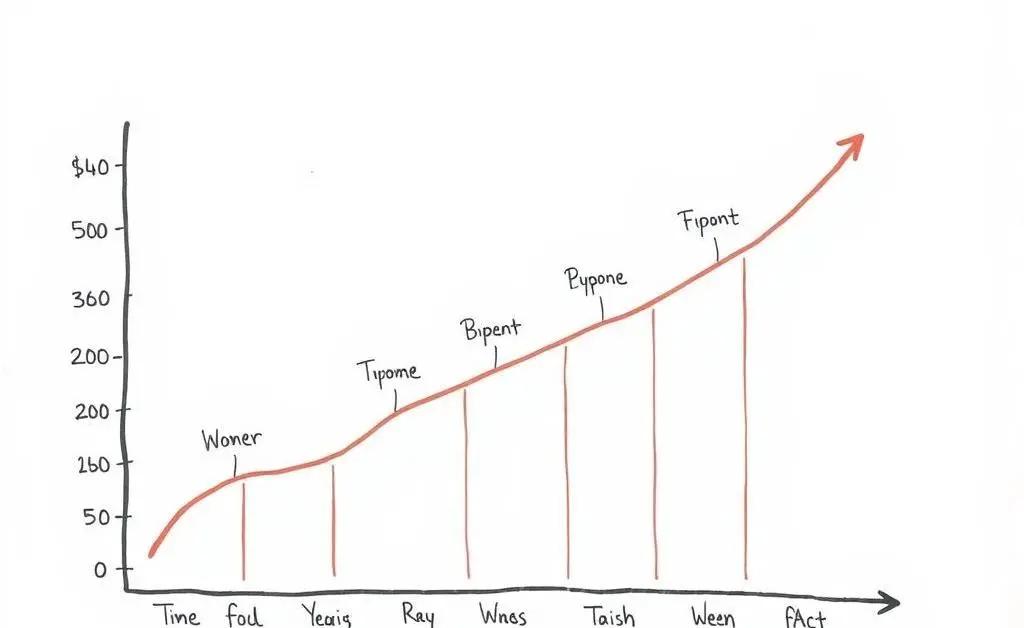

Many people view investing as a daunting task filled with uncertainty. However, informed investment strategies can be less risky than they seem. By starting small, educating yourself on different investment options, and perhaps leveraging resources through your credit union, you can gradually build a strong, diversified portfolio. It doesn't need to start big—it merely needs to start smart.

Taking That First Step

Here's a piece of advice: don't rush it. Financial confidence comes with time, experience, and the willingness to learn from both successes and mistakes. Start by exploring your local credit union options, set up a budget, and dive gently into the world of investments. It’s all about taking one step at a time.

Reflect on this: How comfortable do you feel with your current financial strategy? Are there steps you could take today that might boost that confidence tomorrow? I'd love to hear how you’ve navigated past financial hurdles and what you're aiming for next.