Finding Financial Freedom: A Thoughtful Journey to Early Retirement

Explore practical steps and emotional insights on the thoughtful journey to early retirement.

Have you ever found yourself daydreaming about early retirement, imagining long days spent doing exactly as you please? It's an appealing thought, isn't it? But how do we get there in reality? Let's embark on a thoughtful journey together, exploring practical steps and emotional insights to guide us towards financial freedom.

Understanding Your Financial Goals

Before anything else, it's crucial to have a clear picture in your mind of what early retirement means for you. Take a moment to think: What does your ideal day look like when you're not tied to a 9-to-5 job? Whether it involves traveling, starting a passion project, or simply enjoying a quiet life with loved ones, defining this dream will provide motivation and clarity on your path.

Creating a Personalized Budget Plan

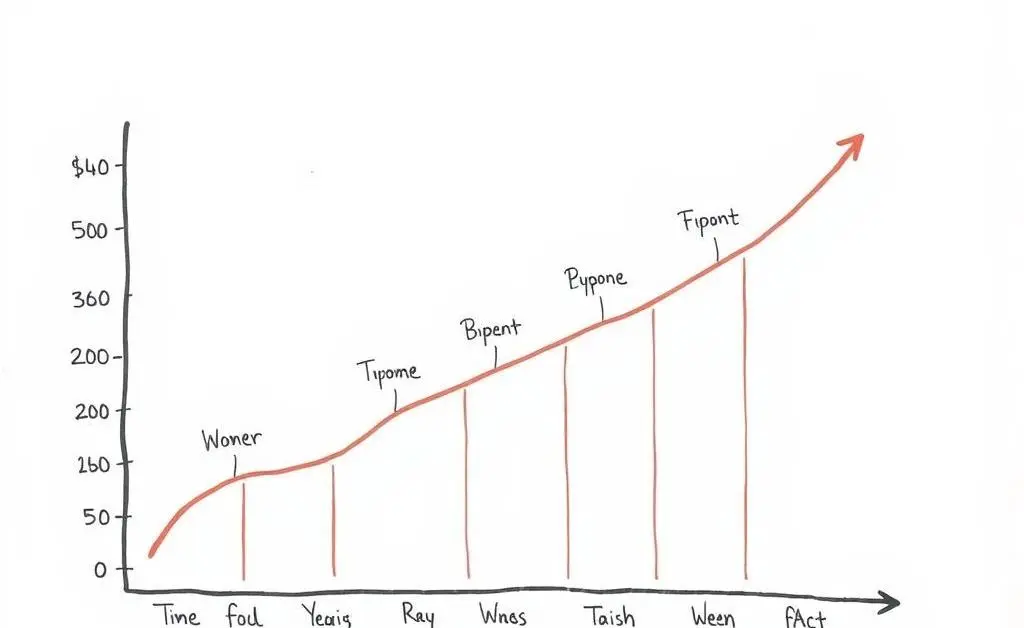

Once you have your dream in sight, the next step is grounding it with a solid financial plan. Developing a budget that reflects your current situation and future aspirations is essential. Look at your income, expenses, and potential for savings. You might even want to explore tools like budgeting calculators to get precise insights.

Practical Tips for Budgeting:

- Track your spending for a month to understand patterns.

- Identify non-essential expenses that can be minimized or eliminated.

- Set realistic savings goals based on your financial milestones.

- Regularly assess and adjust your budget to stay aligned with your goals.

Building Confidence in Your Investment Choices

Investing can be intimidating, no doubt. But it's a vital piece of the financial independence puzzle. Start by learning the basics and slowly diversify your portfolio. Remember, knowledge builds confidence, and this journey should never be rushed.

Steps to Gain Investment Confidence:

- Begin with introductory courses on investing.

- Consider speaking with a financial advisor.

- Start small by investing in low-risk funds or stocks.

- Regularly review your investments and adjust as needed.

The Emotional Side of Financial Planning

While the numbers are essential, emotional readiness plays a significant part in this journey. Are you emotionally prepared to transition away from a traditional career? Early retirement isn't just about quitting your job; it's about crafting a fulfilling life outside work. It's vital to align your emotional readiness with your financial progress.

A Final Thought

As we wrap up this chat, remember that the journey to early retirement is deeply personal and unique for everyone. It's a blend of strategic planning and heartfelt desires, all stitched together by your courage and determination. Stay curious, be compassionate with yourself, and enjoy each step closer to your financial freedom.