Finding Financial Fulfillment: What to Do After Opening Your Investment Account

Discover practical steps to navigate your financial aspirations after opening an investment account.

Congratulations on opening your investment account! It's a significant step, and now you're probably wondering, "What next?" This stage can feel like standing at the crossroads, with each path promising a unique experience and destination. Let's explore how to navigate these opportunities confidently and thoughtfully.

Setting Intentional Financial Goals

Before diving into the vast world of investments, it's essential to pause and reflect on your life goals. Think about what financial security means to you. Is it an early retirement, buying your dream home, or perhaps traveling the world?

Jot these aspirations down in your favorite journal or note-taking app. Writing them can often transform vague ideas into clear targets, letting you visualize your path forward.

Diversifying Your Portfolio

You've heard it time and again: don't put all your eggs in one basket. The same wisdom applies to investments. By diversifying, you spread your risk, making your financial journey more resilient to market fluctuations. Consider exploring a combination of:

- Stocks: A slice of a company, offering growth potential but with higher risk.

- Bonds: Loans you give to corporations or governments, typically providing stable returns.

- Real Estate: Physical property investment that can hedge against inflation and offer rental income.

Balancing Finances and Well-being

As you build your portfolio, remember that financial health is just one aspect of life. It's equally important to balance it with emotional and physical well-being. Don't overwhelm yourself by constantly checking market trends. Instead, schedule regular check-ins, perhaps quarterly, to evaluate your investments.

Set reminders to review your goals and consider adjustments, helping ensure your financial path aligns with your evolving life priorities.

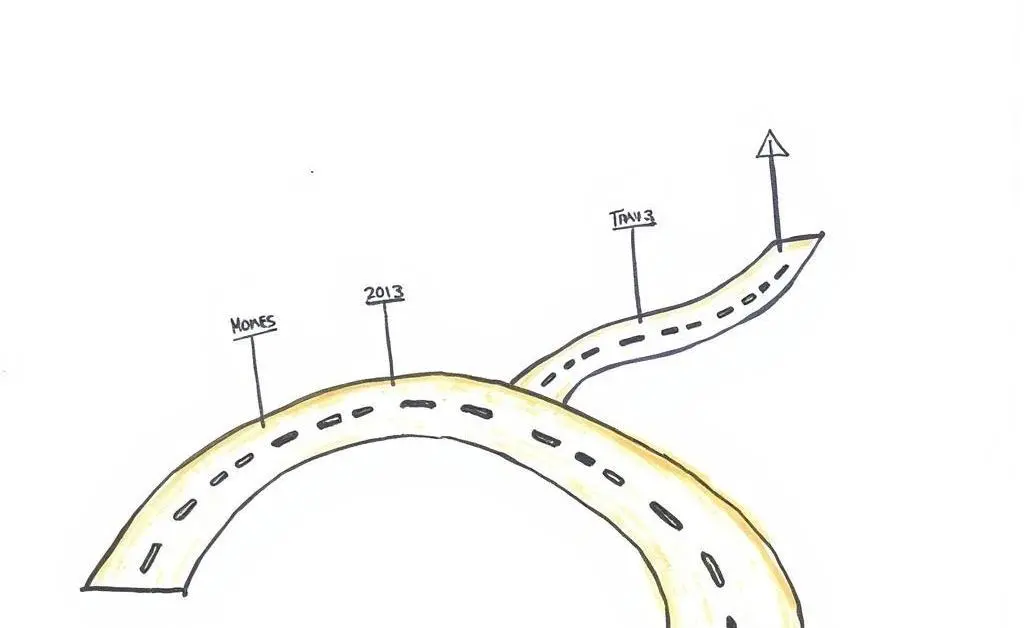

Learning and Evolving

The world of finance is dynamic, and so should your approach be. Consider enrolling in webinars, joining investment clubs, or subscribing to trusted financial podcasts. The more you learn, the more empowered you'll feel making informed decisions.

Lastly, remember that financial planning is a journey, not a destination. Celebrate each milestone, no matter how small, and stay curious about what lies ahead.

What steps have you found most helpful in your financial journey? Please share your insights, as they may light the way for others embarking on similar adventures!