How a Speeding Ticket Can Drive Up Your Insurance Costs

A speeding ticket could raise your insurance costs—explore why and what you can do about it.

Ever felt the thrill of a fast drive, only to be jolted back to reality by the sight of flashing lights in your rearview mirror? Yeah, not fun. But did you know that speeding ticket might cost you more than just the initial fine? It can actually cause a spike in your insurance rates, affecting your budget in the long run.

Why Insurance Companies Care About Your Speeding Ticket

Insurance rates are all about risk assessment. When you get a speeding ticket, insurers view you as a higher-risk driver. The logic is simple: if you speed, you're more likely to get into accidents. And more accidents mean more payouts for them. That's not something they enjoy.

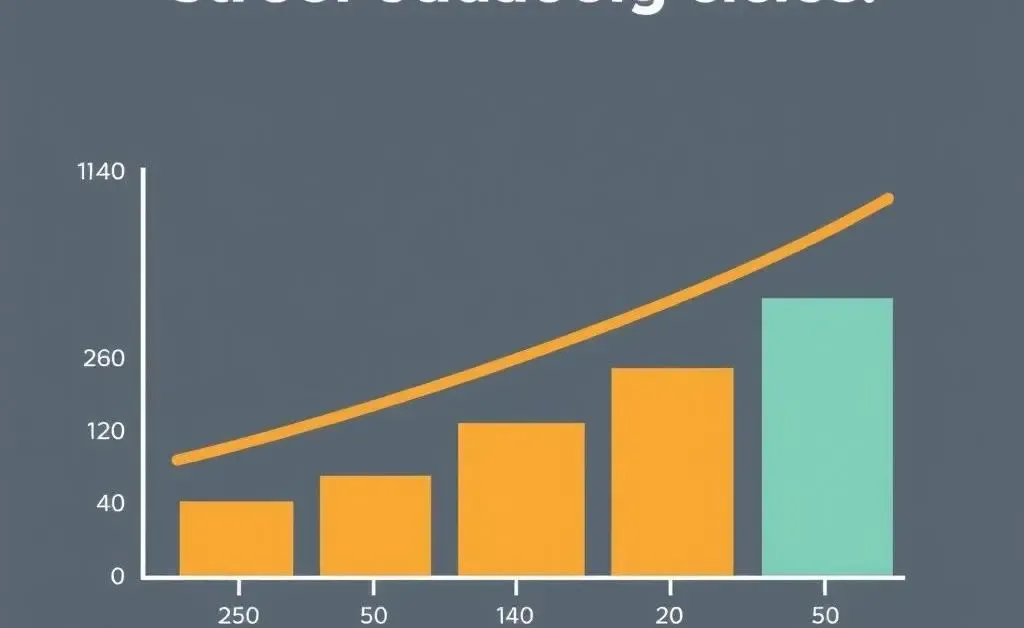

How Much Could Your Rates Increase?

The impact on your rates can vary. On average, a single speeding ticket could increase your auto insurance premiums by about 20%. Of course, factors like your driving history, location, and even the speed you were going play a significant role.

- First-time offenders: Expect around a 15-20% increase.

- Repeated speedster: Could see rates go up by 30% or more.

What Can You Do to Minimize the Impact?

Getting a speeding ticket doesn't mean you're doomed to high insurance premiums forever. Here's what you can do:

- Drive safely: Stick to speed limits and practice defensive driving to prevent future tickets.

- Shop around: Different insurers assess risks differently, so another company might offer a better rate, speeding ticket notwithstanding.

- Take a defensive driving course: Some insurance companies offer discounts for completing these courses, even if you have a blemish or two on your record.

Share Your Story

Have you faced a similar situation? What strategies worked for you in handling a speeding ticket's impact on your insurance costs? Feel free to share in the comments!