How Automation is Changing the Game for Canadian Insurance Agents

Discover how automation is revolutionizing the Canadian insurance industry.

Hey there! If you're anything like me, you might occasionally wonder how technology is reshaping everyday jobs, especially in fields like insurance. Recently, I've been diving deep into how automation is changing the game for insurance agents in Canada, and let me tell you, it's a fascinating shift!

Why Automation Matters for Insurance Agents

So, why is everyone buzzing about automation in the insurance world? Simply put, automation helps agents do their jobs more efficiently. By streamlining repetitive tasks, insurance agents in Canada can focus more on personalized client care. From automated policy renewals to claim processing, the benefits are noticeable.

The Benefits of Automation

Let’s break down some benefits:

- Time Savings: Agents spend less time on paperwork and more on building client relationships.

- Error Reduction: Automation minimizes human error in data entry and processing.

- Improved Customer Experience: Clients enjoy faster service and receive quotes or policy renewals in minutes.

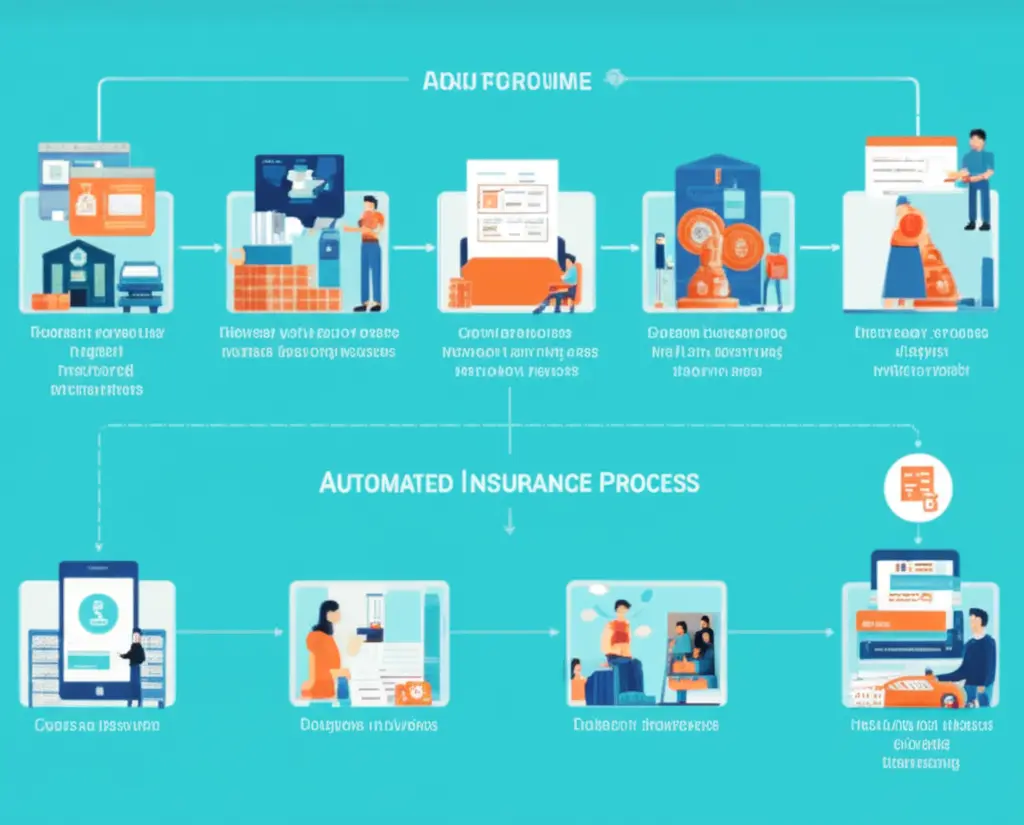

Commonly Automated Tasks in Insurance

Insurance agents are using automation tools for various tasks, such as:

- Quote Generation: Automated systems quickly generate insurance quotes based on input data.

- Claims Processing: Automated processes can evaluate claims and even trigger payments without manual input.

- Client Communications: Automated emailing systems keep customers informed about policy updates or renewals.

Embracing Technology Responsibly

While automation offers numerous benefits, it’s crucial for agents to handle these tools responsibly. Maintaining a personal touch is essential, ensuring clients feel valued rather than just a number in a system.

Conclusion: The Road Ahead

As technology continues to advance, the role of the insurance agent will evolve. Embracing automation will not only streamline workflows but also enrich customer interactions. What are your thoughts on automation in the insurance industry? Feel free to share your insights!