How Financial Independence Transforms Your Mindset: A Practical Journey

Discover how achieving financial independence reshapes your priorities and mindset in life.

Why Does Financial Independence Matter?

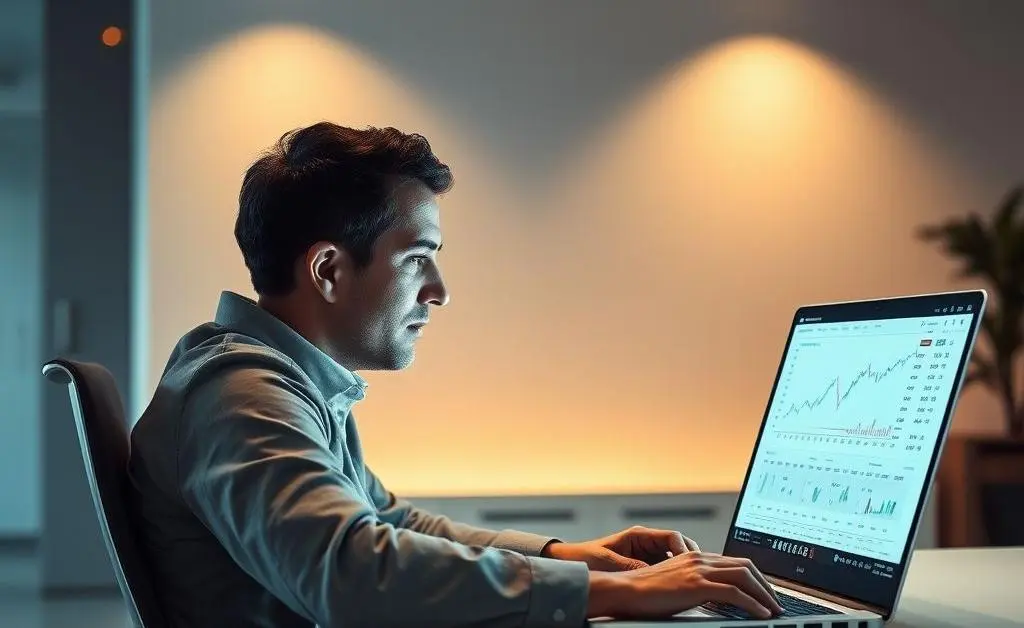

Imagine waking up knowing that you don't have to work for money anymore. No, it's not a fantasy; it's what financial independence feels like. Achieving financial independence doesn't mean you never work again; it shifts your mindset, allowing you to work on what truly matters to you. Financial independence empowers you and gives you more control over your life and future.

Redefining Success and Productivity

Once you reach financial independence, the concept of success might change for you. It's no longer just about climbing the corporate ladder. Instead, it becomes about pursuing projects that align with your passions and values. The freedom to choose creates a new form of productivity — one that's driven by motivation and personal goals rather than necessity.

Setting New Life Priorities

With the financial safety net in place, your priorities often shift. Many people find themselves spending more time on health, relationships, and personal development. It's a holistic approach where time investment is directed toward fulfilling experiences rather than accumulating wealth.

The Practical Benefits of Financial Independence

One of the practical benefits is reduced stress about money. You have a buffer that protects you against unexpected financial setbacks. You might also find yourself making better, more thoughtful life decisions because you're not just reacting to financial pressure.

- Freedom to travel and explore without financial constraints

- Ability to take sabbaticals to learn new skills or pursue higher education

- Opportunity to volunteer more and give back to the community

Finding Your Path to Financial Independence

Reaching this goal requires planning and discipline. Here are steps you can take to start your journey:

- Create a realistic budget tailored to prioritize savings and investment

- Invest in knowledge — learn about various investment strategies

- Eliminate high-interest debt and focus on increasing your savings rate

Takeaways

Financial independence is more than just having money; it's about altering your mindset and life plan. Whether you're just starting your journey or close to achieving your goals, keep in mind that it's a deeply personal experience. What will you do once you have the freedom to decide?