How Interest Rate Cuts Could Influence Your Financial Planning

Explore the impact of potential interest rate cuts on your finances and investments.

Have you ever found yourself scratching your head when you hear headline stories about interest rate cuts and their potential impacts? Don't worry, you're not alone. Understanding financial news can sometimes feel like deciphering hieroglyphics. But here's a simple breakdown to transform that confusion into clarity.

What's the Deal with Interest Rate Cuts?

First off, if you’ve heard that the Federal Reserve might cut interest rates, it's mostly about managing the economy. Think of it like adjusting the thermostat in your house to maintain comfort as outside temperatures change. When the economy seems a bit too sluggish, rate cuts can inject some warmth, encouraging borrowing and spending. Our primary keyword here is interest rate cuts.

How Does This Affect Your Wallet?

Okay, let's talk practicalities. If you have loans or credit card debts, interest rate cuts can make borrowing cheaper, which is a win for paying off debt. However, it might not be as exciting for savers since lower rates often mean lower returns on deposits.

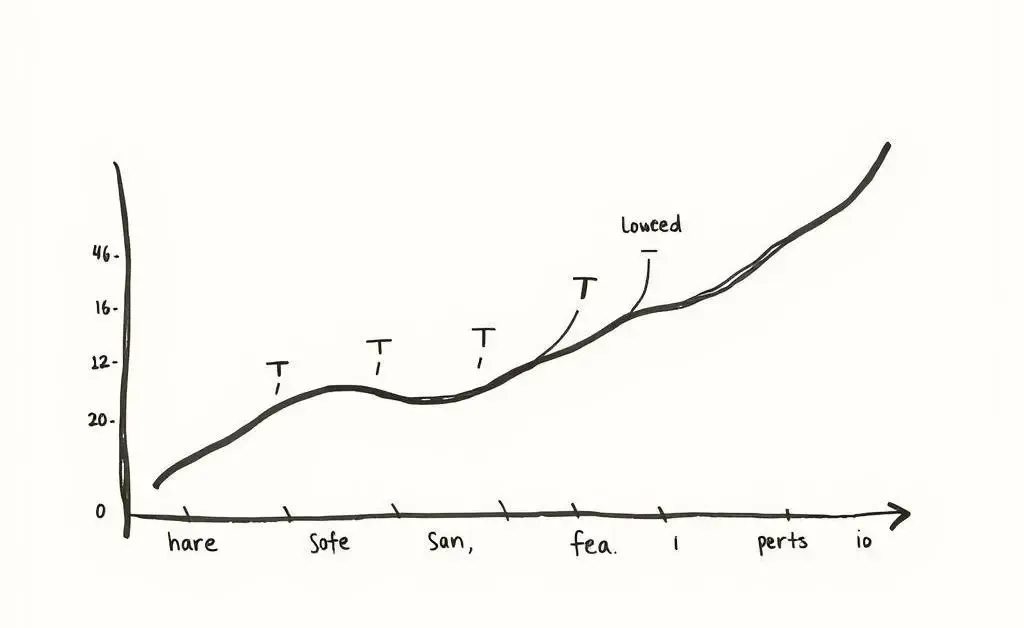

Investment Perspectives

Wondering about your investment strategy? Rate cuts can potentially boost stock markets as cheaper borrowing can lead to business growth and higher profits. But be aware: markets can be unpredictable, and it's essential to consider your risk tolerance.

Steps to Take Next

- Review Loans: Check if it's a good time to refinance and reduce your interest rates.

- Assess Savings: Consider shifting some funds if savings account returns decrease.

- Long-term Investments: Keep an eye on your portfolio and consult with a financial advisor if you're unsure about market movements.

Thinking Ahead

Ultimately, it's all about aligning your financial strategies with these economic shifts. Think of your finances like a sailboat—the wind (interest rates) might change, but with a bit of steering, you can stay the course toward your goals.

So, how do you plan to adjust your finances with potential rate cuts on the horizon? Leave your thoughts in the comments and let's start a conversation!