How Lower Federal Interest Rates Could Affect Real Estate in 2024

Explore how dipping interest rates could reshape the real estate market in 2024.

Hey there, real estate enthusiasts! Today, we're diving into a topic that's on many minds: What happens to the real estate market when the Fed lowers interest rates? It's a question that can send shivers of excitement or worry down the spine of potential home buyers, real estate investors, and sellers alike.

Understanding the Impact of Interest Rates on Real Estate

Let's kick things off with why interest rates matter so much. In essence, when the Federal Reserve lowers interest rates, borrowing becomes cheaper. This can boost everything from mortgages to car loans, sparking more activity in the housing market.

How Do Lower Rates Affect Buyers?

For buyers, lower interest rates often mean more affordable mortgage payments. Here's the kicker: the total price you pay for a home can decrease, opening doors for more people to afford buying a house. Yay for aspiring homeowners!

Increased Affordability

Lower rates can translate into saving thousands over the life of a loan. For example, a slight drop of 1% on a $300,000 home can knock off quite a bit from monthly payments, making homeownership accessible to a wider audience.

A Surge in Demand

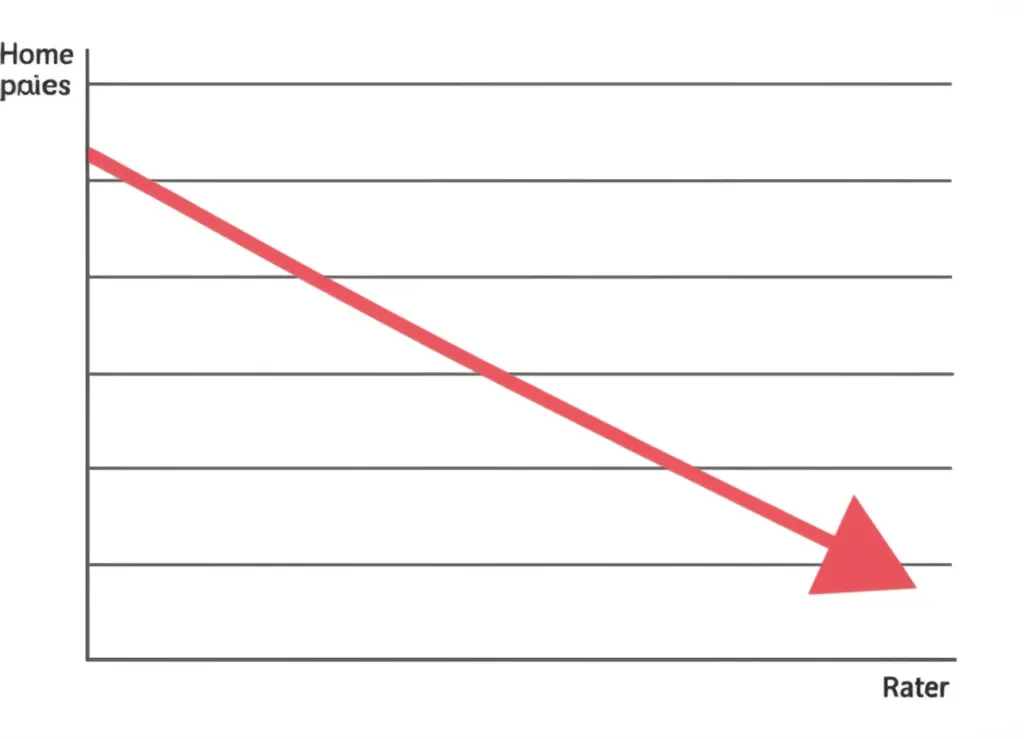

Cheaper borrowing can also lead to increased demand. More people jumping into the market can lead to more competition, pushing home prices up in some areas. It's a classic case of supply and demand: when there's an influx of buyers, sellers can often fetch higher prices.

Effects on Home Sellers and Investors

Sellers, rejoice! Lower interest rates can make properties seem more enticing, especially if you've been sitting on a listing for too long. Meanwhile, investors may find lucrative opportunities to expand their portfolios as properties potentially appreciate in value.

Potential Drawbacks

It's not all sunshine and rainbows, though. High demand can lead to bidding wars, and in some hot real estate markets, prices might escalate beyond reasonable limits, edging out newcomers.

So, what's the takeaway here? A potential drop in interest rates can open up exciting opportunities for buyers and sellers, but it's essential to stay savvy and informed to make the most of it.

Final Thoughts

So, would you take the plunge and invest in real estate if rates went down? It's a dynamic market, and there's no one-size-fits-all answer. Share your thoughts below—I'd love to hear them!