How Mortgage Brokers Make Money: A Simple Guide

Discover how mortgage brokers earn commissions and help you find the best deals.

Ever wondered how your friendly neighborhood mortgage broker gets paid? You're not alone. Understanding how these vital partners in home buying earn their living can demystify the mortgage process and help you make smarter financial decisions.

What Do Mortgage Brokers Do?

Mortgage brokers are like matchmakers for home loans. They connect borrowers with lenders, making it easier to find the best mortgage deals tailored to each client’s needs. Think of them as your personal finance concierge in the convoluted world of real estate.

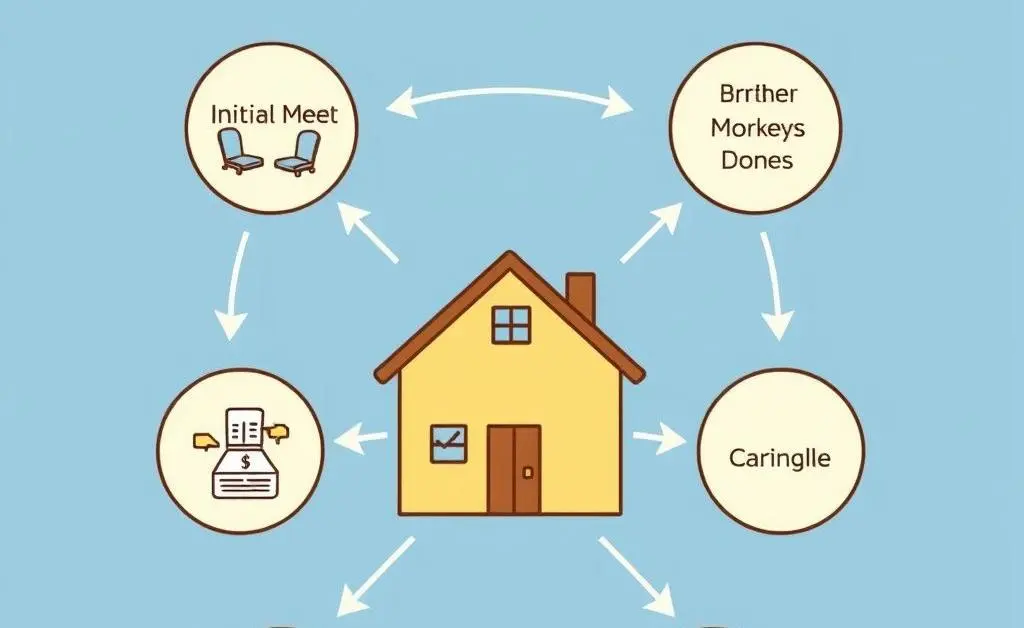

How Do Mortgage Brokers Make Money?

Unlike traditional employees, mortgage brokers earn commissions. Here’s a quick breakdown:

- Commission from Lenders: Brokers receive a commission from the lender for each mortgage they successfully close. This percentage typically ranges from 0.5% to 1% of the loan amount.

- Fee to Clients: Some brokers may also charge clients a flat fee or a percentage of the loan amount in addition to lender commissions.

How Does This Affect Borrowers?

Good brokers will prioritize your needs and find you the best loan, as their success depends on satisfied clients and repeat business. However, it's always wise to ask tough questions. Ensure transparency by asking:

- What’s the total broker fee?

- Will there be an additional charge from the lender?

- Are there cheaper options available?

The more informed you are, the better choices you can make.

Why You Might Want a Mortgage Broker

Aside from saving you precious time exploring a sea of options, a mortgage broker can potentially secure lower interest rates due to their established relationships with lenders. Picture this: my friend Sarah was getting ready to buy her first home. With her family’s growing needs, they highly considered the cashback and flexible payment options her broker offered, which ended up saving them a ton on their closing costs. That's a big win!

Are Brokers Worth It?

If a mortgage broker can secure you a better deal than what you're finding on your own, then the answer is a resounding yes. But remember, not all brokers are the same — do a little homework, read reviews, and don’t hesitate to ask questions.

Wrapping Up

Considering a mortgage broker might be a smart move in your home-buying journey, especially for first-time buyers. Their commission-based service can often open doors to lender options and rates you might not get easy access to otherwise. What's your experience with mortgage brokers? Have they been gatekeepers of better rates in your case?