How to Become Debt-Free: Simple Steps for Financial Independence

Explore practical strategies to achieve debt-free living and gain financial freedom.

Becoming debt-free is a transformative journey that can lead to financial peace and freedom. If you're like me, the thought of clearing debts might feel daunting or even impossible, but with a few practical strategies, you can take control of your financial future.

Why Being Debt-Free Matters

Living without debt means less stress and more freedom to pursue what you truly want in life—from traveling to investing in new opportunities. Plus, it improves your financial stability and equips you to handle emergencies better.

The First Step: Understand and Organize Your Debts

The journey begins by identifying what you owe and to whom. List down each of your debts, including the interest rates and minimum payments. This gives you a clear picture of the task ahead.

Create a Budget That Works for You

Every successful debt-elimination strategy starts with a solid budget. Allocate funds for your needs, wants, and savings. Use simple budgeting methods like the 50/30/20 rule to guide your monthly expenses.

Strategies to Pay Off Debt Efficiently

The Snowball Method

If you’re motivated by seeing quick wins, the snowball method might work perfectly for you. Focus on paying off the smallest debts first while making minimum payments on the rest.

The Avalanche Method

For those looking to save on interest payments, consider the avalanche method, where you tackle debts with the highest interest rates first. This can minimize the total interest paid over time.

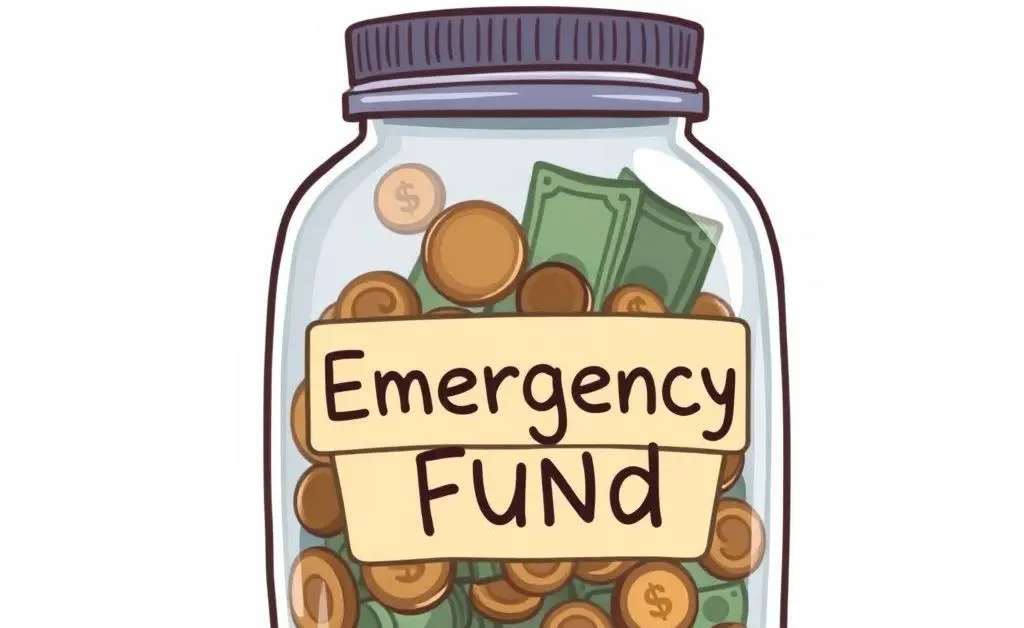

Don’t Forget to Build an Emergency Fund

Having a small emergency fund can prevent future debt. Start with a goal of $500 to $1,000 to cover unforeseen expenses without reaching for a credit card.

Beyond Debt: Building a Financially Secure Future

Once you’ve eliminated your debts, it’s time to focus on building wealth. Consider investing a portion of your newfound extra cash and expanding your emergency fund. Explore low-risk investments or increase contributions to your retirement fund.

In conclusion, becoming debt-free is not just about the absence of debt but the presence of opportunity and security. What are some financial goals you'd pursue once free of debt?