How to Budget Like a Pro: Simple Steps to Achieve Financial Freedom

Learn practical budgeting tips to gain financial freedom and peace of mind.

Hey there! Have you ever found yourself wondering how people manage to stick to their budgets so effortlessly? If you're looking to master the art of budgeting and achieve financial freedom, you're in the right place. I've gathered some practical tips that have worked wonders for many, including myself, and I can't wait to share them with you.

What Exactly Is Budgeting?

Before diving into the nitty-gritty, let's clarify what budgeting really means. Simply put, budgeting is all about creating a plan for your money. It's like giving each dollar a purpose, ensuring you're prepared for both expected and unforeseen expenses. If you're ready to get started, let's break down the process into manageable steps!

1. Setting Clear Financial Goals

The first step to effective budgeting is to know what you're working towards. Do you want to pay off debt, save for a house, or enjoy a nice vacation? Clearly defining your financial goals gives you a roadmap to follow, making it easier to stay motivated.

2. Assessing Your Income and Expenses

It's time for a deep dive into your finances. List all sources of income and categorize your expenses. This might seem tedious, but understanding where your money comes from and goes will be eye-opening. Many are surprised by how much they spend on things like dining out or subscriptions.

3. Creating a Realistic Budget

Now that you have a clear picture of your finances, create a realistic budget based on your goals. Allocate funds for essentials like rent, groceries, and utilities, but don't forget to set aside some fun money too. A budget should guide you, not make you feel deprived.

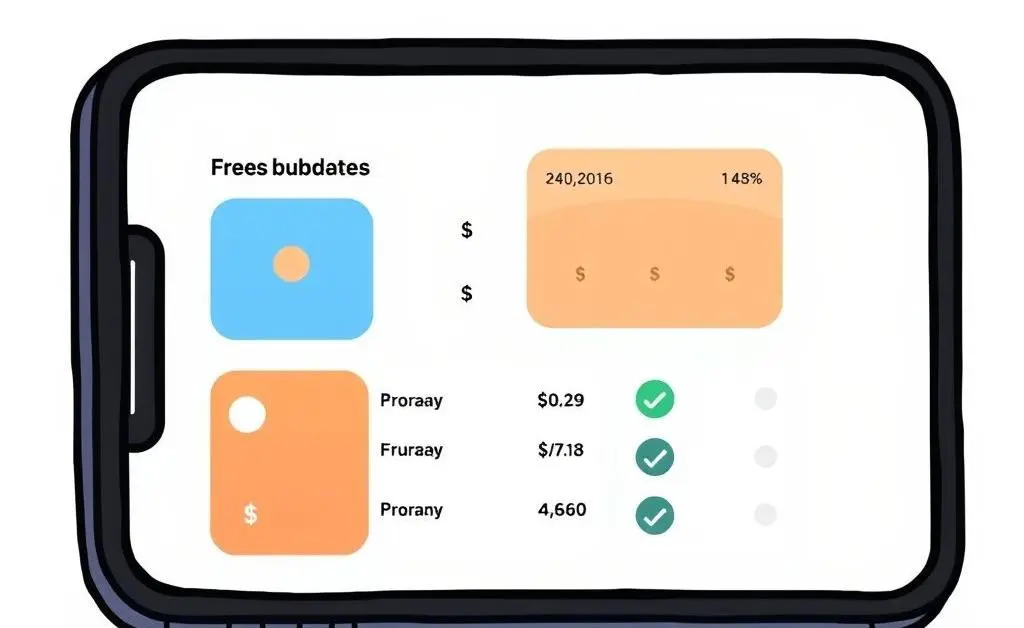

4. Using Tools to Stay on Track

Let's talk tech! There are plenty of budgeting apps out there designed to simplify your finance tracking. Whether you're a spreadsheet enthusiast or app aficionado, find a tool that suits your style. Consistent tracking helps avoid overspending and keeps you accountable.

5. Adjusting and Reflecting

Lastly, remember that life happens, and your budget might need adjustments along the way. Reflect on your progress regularly and make changes as needed. Celebrate small victories and don't be too hard on yourself if things don't go perfectly.

Budgeting is a journey, not a destination. As you become more comfortable managing your money, you'll find financial peace and the freedom to pursue what truly matters to you. So, what's your first step towards budgeting success?