How to Build a Balanced Investment Portfolio: A Practical Guide

Explore strategies for crafting a diversified investment portfolio with ease.

When it comes to investment, building a balanced portfolio is a bit like crafting the perfect pancake recipe—too much of one ingredient can leave a bad taste. Here’s how to find that sweet spot with your investments.

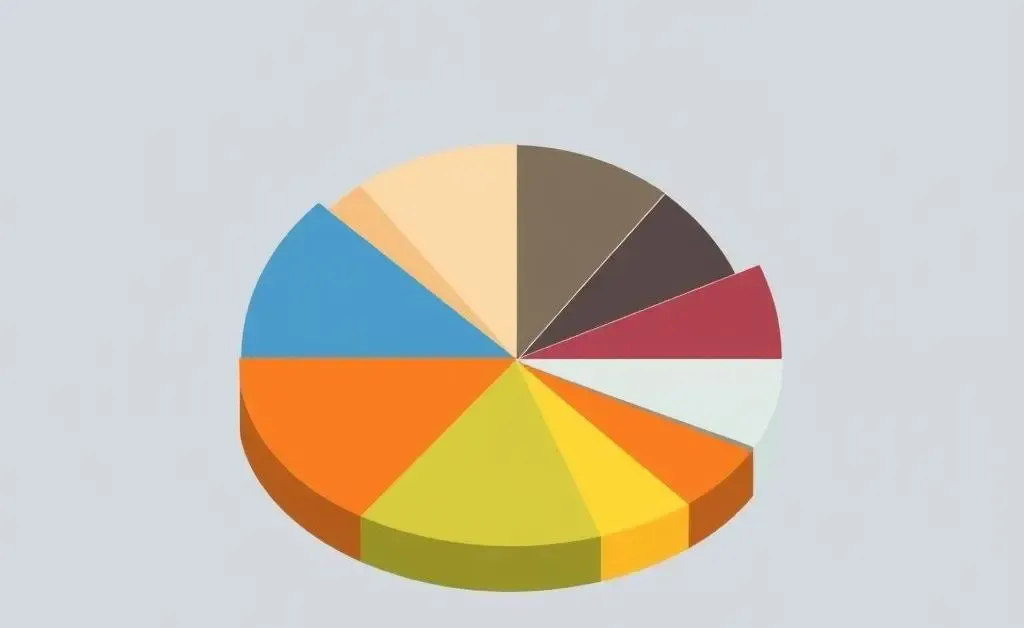

Why Portfolio Diversification Matters

Diversification isn’t just a buzzword; it’s the backbone of a resilient investment strategy. By spreading your investments across various asset classes, you minimize risks. If one sector dips, others may lift you up, maintaining the balance like a well-adjusted scale.

Identifying the Right Investments for You

Start by understanding your risk tolerance. Are you someone who loses sleep over market fluctuations, or are you calm and calculated? Your personality will guide you in selecting the mix of stocks, bonds, or real estate that suit your comfort zone. Think of it like choosing a travel itinerary—some prefer thrilling adventures, while others enjoy laid-back beaches.

Stocks and Bonds: The Building Blocks

Stocks offer growth potential but come with higher risk; bonds are steadier and provide fixed income. Balancing these can be seen as mixing weights on either side of a seesaw, creating equilibrium. An equal distribution might not be necessary or ideal—find what feels right.

Regularly Rebalance Your Portfolio

Investments don’t just sit and simmer like a stew—you’ve got to stir the pot. Regular assessment helps maintain your desired asset allocation and dishes out a helping of peace of mind with a side of financial growth.

Seek Professional Insight

Think of financial advisors as your personal trainers for finance. They provide the expertise and motivation needed to stick to your investment goals, ensuring your portfolio is as brawny as you want it to be.

Final Thoughts

Building and maintaining a balanced investment portfolio is an ongoing journey that requires attention, flexibility, and a little bit of patience. So, what are your go-to strategies for keeping your investments in check? I'd love to hear your thoughts in the comments below!