How to Build a Balanced Investment Portfolio: Beginner Tips and Tricks

Discover practical tips for building a balanced investment portfolio. Start smart and secure your financial future.

How to Build a Balanced Investment Portfolio: Beginner Tips and Tricks

Starting to invest can feel a bit like standing at the edge of a diving board for the first time. You know the water is supposed to be great, but the leap itself seems daunting. The key to a solid financial future is learning how to build a balanced investment portfolio that suits your individual needs. Trust me, it’s not as hard as it looks at first glance.

What is a Balanced Investment Portfolio?

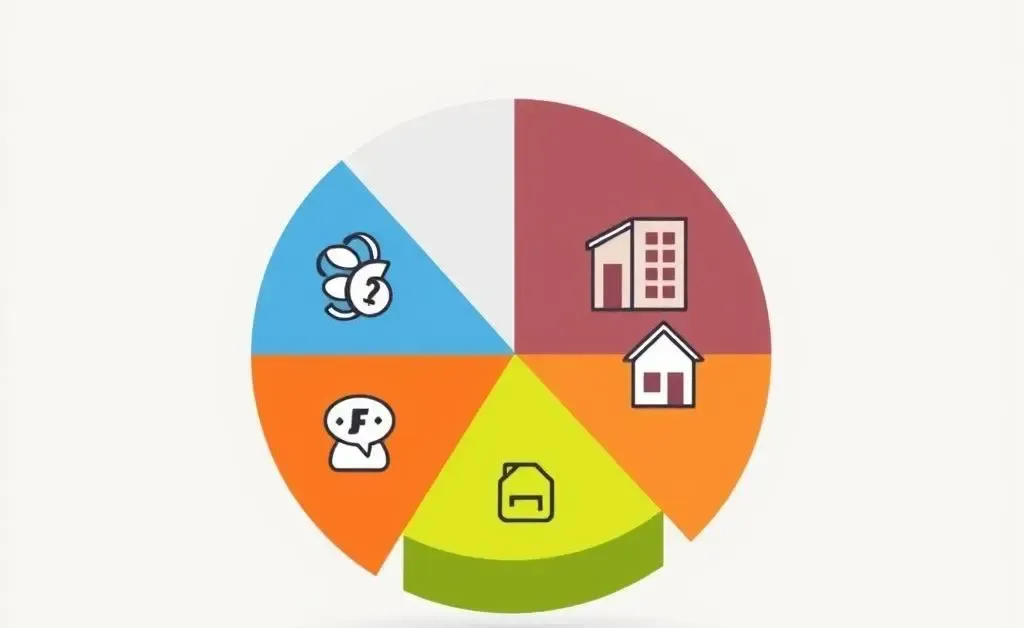

A balanced investment portfolio is like a well-prepared meal. It has the right mix of everything — proteins, veggies, and a dash of spice. Ideally, your investments have a mix of stocks, bonds, real estate, and possibly some other asset classes. This mix helps manage risk and can ensure more stable returns over time.

Why is Diversification Essential?

Diversification is not just a fancy term; it’s the backbone of smart investing. Think of it as not putting all your eggs in one basket. By spreading your investments across various asset categories, you reduce the risk of losing all your money if one particular sector takes a nosedive.

Steps to Building Your Portfolio

1. Define Your Financial Goals

First things first, what are you investing for? Retirement? A house? Define your goals clearly so you can tailor your portfolio accordingly.

2. Assess Your Risk Tolerance

Your financial plan should align with your comfort level. Are you okay with the rollercoaster ride of the stock market, or do you prefer the quiet ride of bonds?

3. Allocate Your Assets Wisely

Divide your investment pie based on your risk tolerance and goals. A typical balanced portfolio might include 60% stocks and 40% bonds, but these numbers can vary. Some might include alternatives like real estate or commodities for more diversification.

Continuous Monitoring and Rebalancing

Once you’ve set up your portfolio, it’s important to keep an eye on how things are going. Markets fluctuate, so rebalancing your portfolio annually or after major market changes can help maintain your desired level of risk.

Final Thoughts

Building a balanced investment portfolio may sound technical, but really, it’s about setting yourself up for success with careful planning and continuous adjustment. Remember, investing is a journey, not a sprint. So grab your compass and let’s get started on crafting a future that elevates your goals.

Have any thoughts or experiences you’d like to share? Leave a comment below! I’d love to hear how you’re shaping your investment future.