How to Build a Diversified Stock Portfolio: Practical Insights and Tips

Discover smart tips for building a diversified stock portfolio that aligns with your financial goals.

Hey there, fellow finance enthusiasts! If you’ve ever felt the excitement mixed with overwhelm when diving into the world of stocks, you’re not alone. Let’s chat about something that’s got everyone buzzing: building a diversified stock portfolio. Whether you’re new to investing or a seasoned pro, crafting the right mix of stocks is like cooking up a perfect meal that satisfies both your taste buds and nutritional needs.

Why Diversification Matters

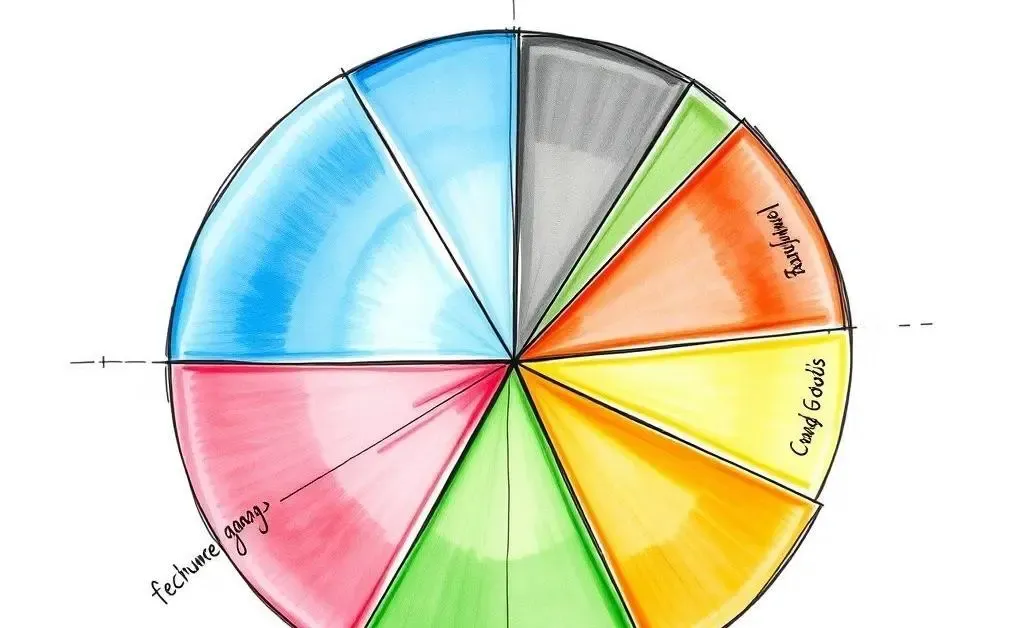

Diversification is one of those terms you hear tossed around a lot. But what does it really mean? At its core, diversification involves spreading your investments across various types of assets to reduce risk. When one sector or stock takes a fall, others can help cushion the blow. Think of it as not putting all your eggs in one basket.

Steps to Build a Diverse Portfolio

So, how do you start building this diversified masterpiece?

1. Assess Your Financial Goals

First off, it’s crucial to identify what you want to achieve. Are you saving for early retirement, or building a college fund for your kids? Your goals will dictate your investment mix, risk tolerance, and time horizon.

2. Choose A Range of Sectors

Diverse sectors are the backbone of your portfolio. Spread investments across industries like technology, healthcare, finance, and consumer goods. Each has its own rhythm and performance cycle.

3. Include Different Types of Assets

Stocks are just the start. Consider bonds, ETFs, and mutual funds. These assets can provide stability, income, and growth depending on their type.

Monitoring and Rebalancing

It’s not enough to set and forget your portfolio; regular check-ups are necessary. Markets are dynamic and ever-changing, so frequent adjustments ensure your portfolio aligns with your goals.

Key Takeaways

Building and maintaining a diverse stock portfolio is part art, part science. With clear goals and thoughtful choices, you can minimize risk and maximize potential returns. Remember to stay informed, be patient, and don’t hesitate to reach out for professional advice if needed.

Got your own portfolio-building tips or stories? I’d love to hear them!