How to Build and Diversify Your Investment Portfolio Like a Pro

Discover the essentials of a balanced investment portfolio in a friendly, skimmable format.

How to Build and Diversify Your Investment Portfolio Like a Pro

Are you looking to take your investment game to the next level but don’t know where to start? Whether you’re a seasoned investor or a curious beginner, building a balanced portfolio is crucial for long-term success.

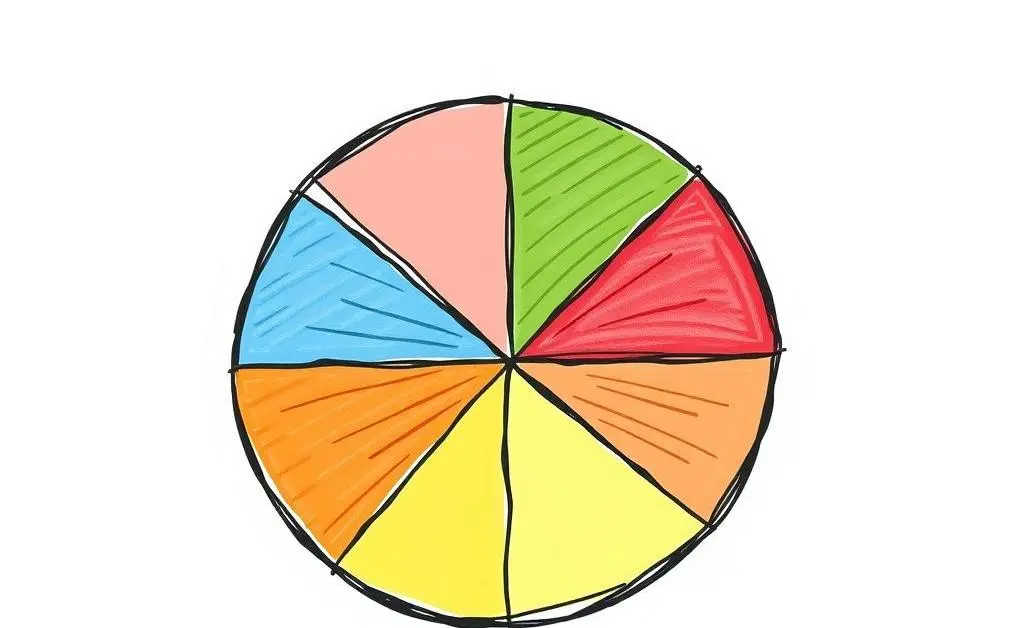

Why Diversification Matters

Diversification is like a safety net, spreading risk across various investments. Think of it like not putting all your eggs in one basket. This way, if one investment doesn't perform well, others can pick up the slack.

Key Benefits of Diversification

- Risk Management: Balances risks across asset types.

- Potential for Higher Returns: Takes advantage of growth in different sectors.

- Smoother Ride: Helps reduce volatility.

Types of Investments to Include

Building a diversified portfolio isn't just about buying random stocks and bonds. It requires thoughtful selection across different asset classes:

- Stocks: Consider a mix of large-cap, mid-cap, and small-cap companies.

- Bonds: Include both government and corporate bonds for stability.

- Real Estate: Real Estate Investment Trusts (REITs) offer stable income potential.

- Index Funds: Add them for broad market exposure.

A Tale of Two Investors

Let’s meet Tim and Sarah. Tim puts all his money into tech stocks. Sarah spreads hers across various sectors. When the tech bubble bursts, Tim is in panic mode, whereas Sarah's balanced portfolio is holding up. Sarah might not have struck gold with a single investment, but she also isn't facing losses overnight.

Crafting Your Portfolio

So, how do you start crafting your own Tim-proof portfolio?

- Identify Your Risk Tolerance: Are you a risk-loving adventurer or a cautious navigator?

- Do Your Homework: Research and choose quality investments.

- Rebalance Regularly: Check your allocations every six months and adjust as needed.

Final Thoughts

Choosing the right mix of investments isn’t about picking the latest hot stock; it’s about creating a well-rounded portfolio that reflects both your financial goals and risk tolerance.

Now that you've gotten your new portfolio started, what's your strategy for continuing to learn and adapt? Let's keep this conversation going!