How to Build Financial Confidence: Steps Toward Empowerment

Discover practical steps to boost your financial confidence and take control of your future.

Gaining financial confidence is more than just crunching numbers—it's about feeling empowered to make informed decisions and managing your money in a way that aligns with your goals. Personal finance can feel like a labyrinth of complexity, but with a few practical steps, you can navigate your way toward financial empowerment.

Why Does Financial Confidence Matter?

Confidence in your financial decisions can significantly impact your life. It alleviates stress, reduces financial anxiety, and enables you to make choices that reflect your values and aspirations. Plus, being confident with money is about setting the stage for future stability and growth.

Step 1: Assess Where You Stand

The first step in building financial confidence is understanding your current situation. Grab a cup of tea, a cozy blanket, and take a good look at your financial documents.

- Track Your Expenses: Use a budgeting app to see where your money goes.

- Know Your Income Sources: List out all streams of income to have a clear picture of your financial inflow.

- Evaluate Your Debts and Assets: Make a list of what you owe vs. what you own. This will give you a snapshot of your net worth.

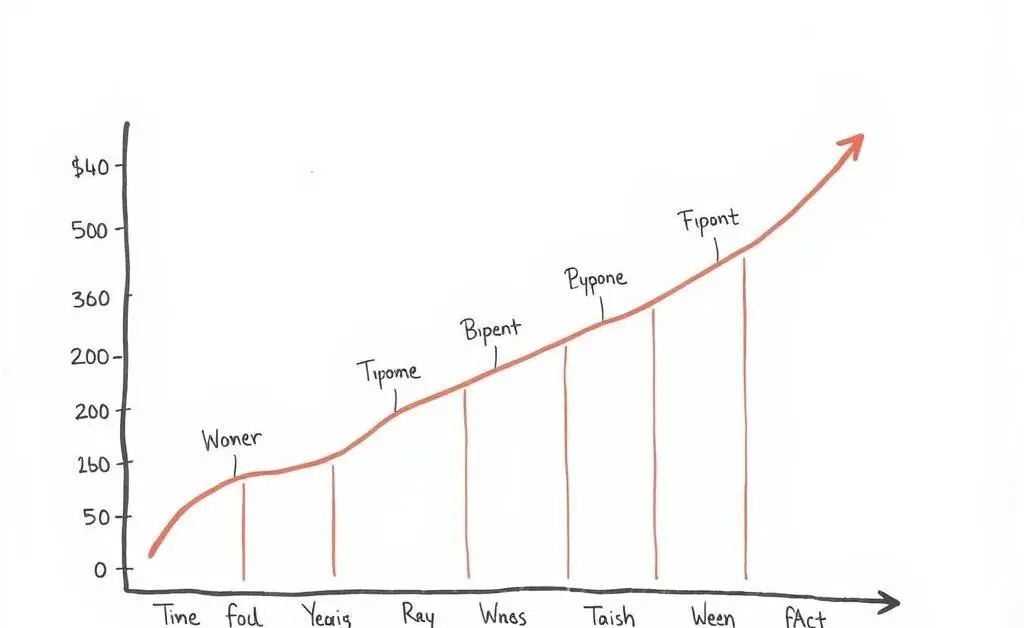

Step 2: Set Clear Goals

Goals provide direction and motivation. Start with small, achievable targets before mapping out larger long-term objectives.

- Define Short-term Goals: These might include paying off a specific debt or increasing your savings by a certain percentage in six months.

- Identify Long-term Goals: Think of your future - retirement, buying a home, or planning that dream vacation.

- Adopt the SMART Goals Framework: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

Step 3: Educate Yourself

Knowledge is power—especially when it comes to finances. Learn about investment options that align with your risk tolerance.

- Consider reading books such as The Millionaire Fastlane.

- Attend free workshops or webinars on personal finance basics.

- Join online communities where you can discuss financial strategies.

Step 4: Build a Support System

Surround yourself with a community that supports your financial ambitions.

- Seek mentorship from someone who’s successfully managing their finances.

- Discuss your financial goals with friends or family to maintain accountability.

- Join clubs or online forums where you can exchange tips with like-minded individuals.

Conclusion: Taking Charge of Your Financial Future

Financial confidence isn't built overnight, but every step you take toward understanding and managing your resources better gets you closer. As you embark on this journey, take pride in each milestone you reach. What's the next step you'll take to boost your financial confidence?