How to Choose the Right Health Insurance Plan for You

Learn how to find the best health insurance plan that fits your needs, budget, and lifestyle.

Choosing the Right Health Insurance Plan Is Easier Than You Think

Picking the right health insurance plan can feel like solving a complex puzzle. With countless options and confusing jargon, it's no wonder many of us end up overwhelmed. But don't worry, you're not alone in this labyrinth. I've been in your shoes, and together, we'll navigate through the healthcare jungle!

Understand Your Health Needs

Start with a critical assessment of your health needs. Do you visit doctors frequently, or is a yearly check-up enough for you? Understanding your unique requirements is the first step towards finding the plan that suits you best. Consider factors like ongoing medical conditions, regular prescriptions, and potential specialists you might need.

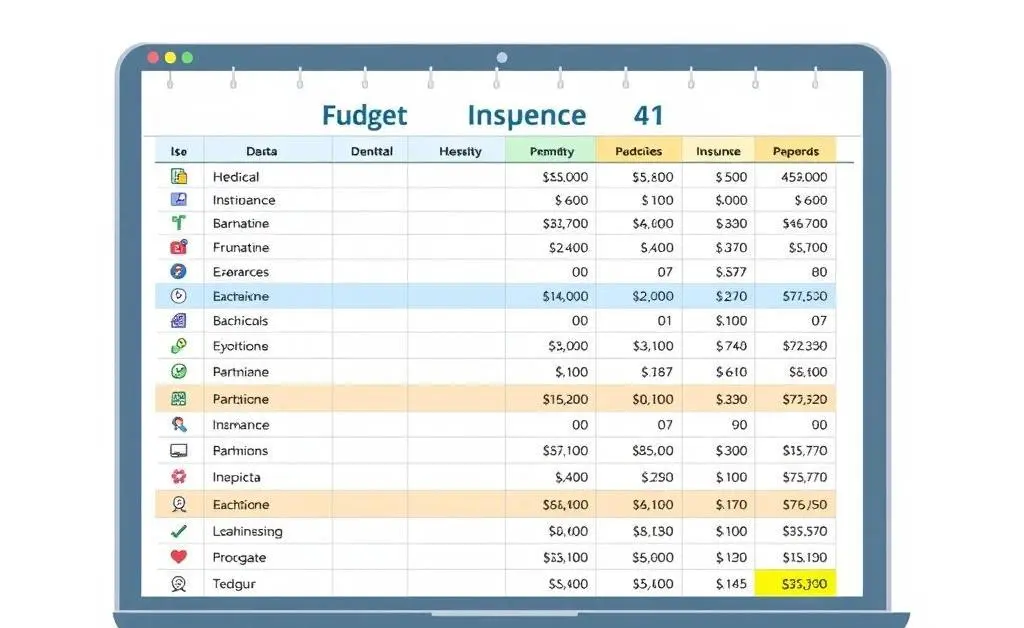

Know What You Can Afford

Next, let's talk numbers. Budgeting for health insurance is crucial, as it impacts not only your finances but also your overall well-being. Factors like deductibles, premiums, and out-of-pocket maximums can make or break your budget. Use online calculators, or better yet, a simple spreadsheet can work wonders in breaking down expenses. Trust me, a little financial organization goes a long way!

Explore Plan Types

When it comes to health insurance, acronyms abound. HMO, PPO, EPO, POS — it's like wrestling with alphabet soup! Here's a quick primer:

- HMO (Health Maintenance Organization): Lower premiums, but you need referrals to see specialists.

- PPO (Preferred Provider Organization): Flexible but pricier; you can see specialists without a referral.

- EPO (Exclusive Provider Organization): A middle-ground, offering lower costs but requiring you to stay within network.

- POS (Point of Service): Combines features of HMO and PPO, giving choices with varying costs.

Consider Family Needs

If you're insuring a family, factor in their needs too. Kids might need different health services, from pediatricians to vaccinations. A family plan should be a cozy fit for everyone. Communication with family members can unveil surprising needs and make choosing the right plan a team effort.

The Final Word

Ultimately, choosing a health insurance plan is about balance. Balance your needs, your financial capability, and your peace of mind. You've got this! And remember, if you ever find yourself lost, reaching out to a licensed insurance advisor can provide clarity and guidance. Now, I'd love to hear your thoughts — have you found your perfect health plan yet? What's your biggest concern when picking a plan?