How to Choose the Right Mortgage Term for Your Future

Discover the best mortgage length for your financial goals in under 5 minutes.

When it comes to taking out a mortgage, one of the most important decisions you'll make is choosing the right mortgage term. Whether you're a first-time homebuyer or refinancing your property, understanding the implications of different mortgage lengths can have a big impact on your financial future.

Why Mortgage Length Is Important

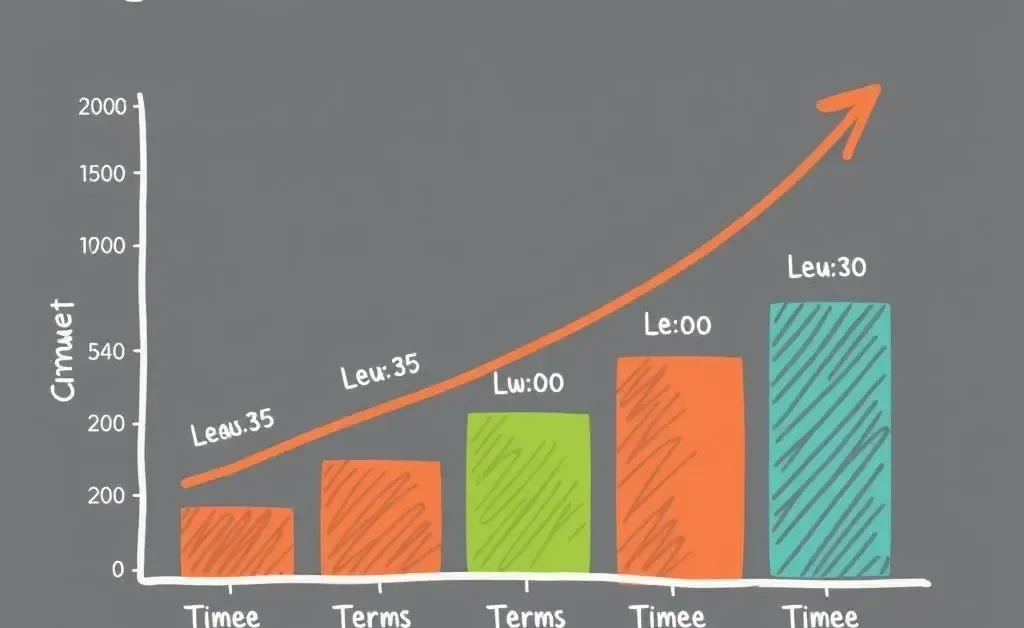

Simply put, the length of your mortgage will affect how much you pay each month and the total amount of interest you'll pay over the life of the loan. A longer mortgage term means lower monthly payments, but you'll pay more interest over time. Conversely, a shorter term means higher monthly payments but less interest overall.

Short vs. Long Mortgage Terms: Which Is Right for You?

It's a classic debate: Do you aim for a shorter term or opt for a longer one to ease monthly financial pressure? Here's a look at the pros and cons:

Short-Term Mortgages

- Pros: Less interest paid, faster equity building, mortgage freedom sooner

- Cons: Higher monthly payments, potential financial strain

Long-Term Mortgages

- Pros: Lower monthly payments, potential for other investments, financial flexibility

- Cons: More interest over time, longer debt commitment

Things to Consider

When deciding on a mortgage term, consider the following:

- Income Stability: Can you comfortably afford higher payments for a shorter-term mortgage?

- Financial Goals: Are you aiming to pay off your home before retirement, or would you prefer to allocate funds to other investments?

- Interest Rates: Locking in a better interest rate could favor a shorter-term mortgage, improving your long-term financial picture.

Conclusion: Finding Your Sweet Spot

Ultimately, the right mortgage term depends on your personal financial situation and future goals. Whether you prioritize flexibility in monthly payments or savings on interest, make sure to weigh all factors carefully.

By thinking about your long-term plans and current financial circumstances, you'll be better positioned to make an informed choice. Ready to dive in? Let's chat in the comments below!