How to Craft Your Ideal Financial Strategy: A Friendly Guide

Discover practical tips to create a balanced financial strategy that fits your lifestyle.

Do you ever wonder how to align your financial goals with your lifestyle? It's a common question, and one that's not as tricky as it seems. By developing a thoughtful and personalized financial strategy, you can secure a stable future while still enjoying the present. Let’s dive into some practical steps to craft a balanced financial plan that suits you.

Understanding Your Financial Goals

It's essential to clearly define your financial goals. Are you saving for a cosy home, a dream vacation, or perhaps early retirement? Once you know what you're aiming for, planning becomes much easier.

- Short-term goals: Saving for a new gadget or paying off credit card debt.

- Medium-term goals: Planning for a wedding or buying a new car.

- Long-term goals: Building a retirement fund or children's education plan.

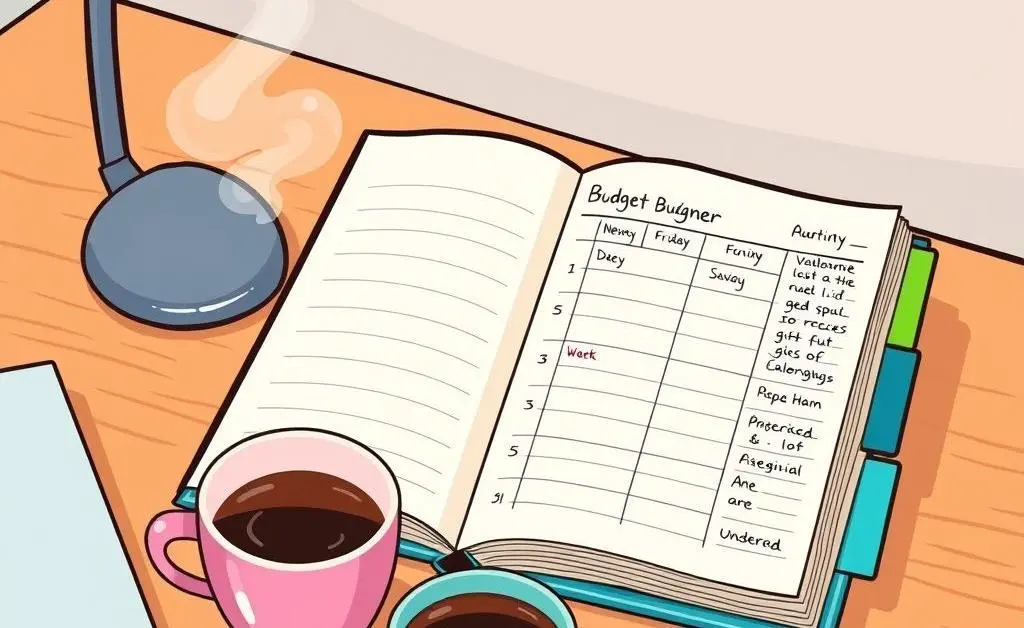

Creating a Budget That's Right For You

A budget is your financial road map. It helps you track expenses and make informed spending decisions. Understanding your spending patterns is the key to financial freedom.

Here's a relatable story: My friend Alex once thought budgeting was all about restrictions, but learned that it's actually about prioritizing. Alex found joy in cooking at home and realized it saved a significant chunk each month—money that went towards a weekend getaway fund instead.

Why Investing Matters

Investing might feel daunting, but it's one of the best ways to grow your wealth. Whether you're interested in stocks, bonds, or mutual funds, understanding the basics will help you make informed decisions that align with your risk tolerance.

Building a Safety Net: Emergency Funds

Life is unpredictable, and having an emergency fund can provide peace of mind. Ideally, you should aim to have three to six months' worth of expenses saved. This fund acts as a buffer for life's unexpected events, from sudden car repairs to medical emergencies.

Planning for Retirement

It's never too early to think about retirement. The sooner you start, the more you can take advantage of compound interest. Explore different retirement savings plans and see what fits your lifestyle.

Remember, your financial journey is unique to you. Embrace it with patience and perseverance, and make adjustments as your life and goals change. What strategies have you found helpful in your financial journey?