How to Grow Your Net Worth from $100K to $1M: A Practical Guide

Maximize your wealth by scaling from $100,000 to a million using smart financial strategies.

Have you ever wondered how to scale your net worth from $100,000 to $1,000,000? It's not as elusive as it seems. With the right strategies, your dream of becoming a millionaire can indeed become a reality!

Understanding the Power of Compounding

First things first, let's talk about compounding. It's the magical ability of your money to grow over time. Imagine planting a tree — it doesn't sprout overnight, but with time and nourishment, it grows into something incredible.

Steps to Get Started

- Save Aggressively: Dedicate a portion of your income to savings and an emergency fund. Aim for at least 20%.

- Invest Smartly: Diversify your investments in stocks, bonds, and mutual funds. Just remember, risk and reward are closely related.

- Minimize Debt: Keep liabilities low to retain as much of your assets as possible.

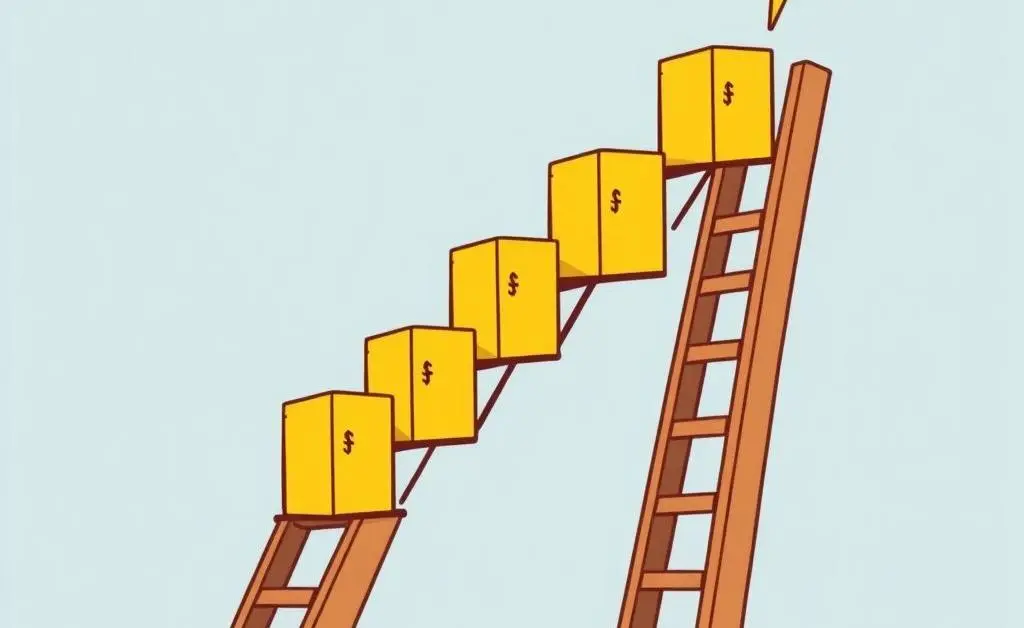

Think of these steps like markers on a ladder. Each one gets you closer to the top.

The Story of Jane and Her Million-Dollar Journey

Let's take a fictional example of Jane who, after a modest salary job and some diligent saving, had amassed $100,000. Instead of letting it sit idly, Jane decided to invest wisely. Over a span of 10 years, she not only enjoyed the exponential growth of her investments but also honed the art of financial discipline.

Maintaining Momentum

Preserving the momentum is crucial. Regularly review and rebalance your investment portfolio to align with your risk tolerance and financial goals. Diversification is key, and rebalancing ensures your portfolio isn't skewed towards a particular risk.

Jane had a rule: Every six months, she would revisit her finances to forecast the next steps towards her million-dollar journey.

Conclusion: The Million-Dollar Question

Scaling your net worth to $1 million isn't just about money; it's about strategy and discipline. It's your roadmap to financial independence. What are the small, actionable steps you can take now to propel your financial future?