How to Handle Unwanted Subscriptions: A Guide to Canceling Services

Learn how to identify and cancel unwanted subscriptions easily, saving money and time.

We’ve all been there—receiving that pesky charge on our account from a service we forgot about. Whether it’s an old newspaper subscription or a streaming service you’ve outgrown, unwanted subscriptions can quickly pile up and drain your finances. So, how do you tackle this issue? Let’s explore some simple ways to identify and cancel those unwanted charges.

Why Canceling Unwanted Subscriptions Matters

First off, cancelling subscriptions you no longer need can save you money. Every dollar counts, and regularly reviewing where your money goes is crucial for effective financial management. Plus, it reduces clutter—both digital and mental—allowing you to focus on what truly matters.

Spotting the Unwanted Subscriptions

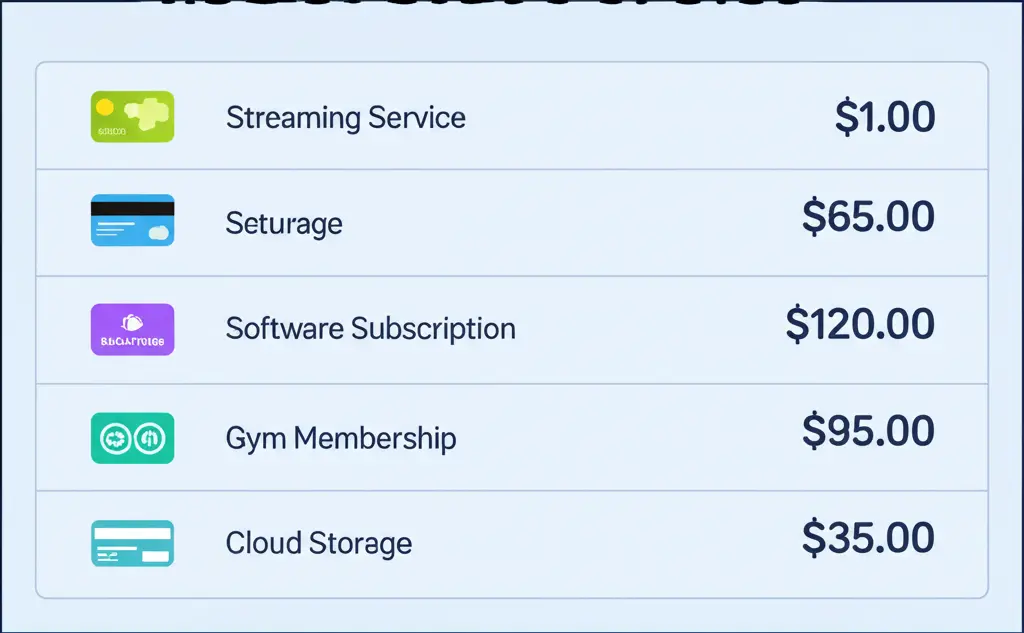

The first step in taking control of your subscriptions is identifying them. Start by going through your recent bank or credit card statements. Look for recurring charges and make a list. You’d be surprised how many sneaky subscriptions float under the radar!

Steps to Cancel Unwanted Subscriptions

Once you've identified the subscriptions you're ready to cut, the next step is cancellation. Here's a step-by-step guide:

- Log In. Access your account on the service provider’s website or app.

- Account Settings. Navigate to your account settings or subscription management page.

- Find Subscription Details. Look for details on your subscription—this is usually under 'Billing' or 'Subscription'.

- Cancel the Subscription. Follow the instructions to cancel. Some services might try to retain you by offering discounts; it’s okay to decline.

- Verify Cancellation. Confirm the cancellation by checking for a confirmation email or notice within your account.

Tools to Manage Subscriptions

Too many subscriptions to handle? Consider using apps designed to manage subscriptions. These apps link to your bank accounts and track all your recurring payments, making it easier to manage or cancel subscriptions you don’t need. Popular apps like Truebill and Bobby can help streamline this process.

Conclusion: Be Proactive About Subscriptions

Managing subscriptions might seem like a small task, but it can have a significant impact on your financial health. Taking the time to audit, manage, and cancel what you don’t need can save you money and stress in the long run. What are your strategies for managing subscriptions? Share your tips in the comments below!