How to Identify Long-Term Market Winners in India

Discover strategies for spotting long-term investment opportunities in India.

Hey there! If you're even mildly curious about the dynamic world of investing, you've probably wondered how to pick the long-term winners in a market as large and varied as India's. Don't worry, you're not alone. Figuring out where to put your money for future gains can be both exhilarating and nerve-wracking. But today, we're diving into some practical strategies that can help us identify where to find the most promising opportunities.

Why Focus on India?

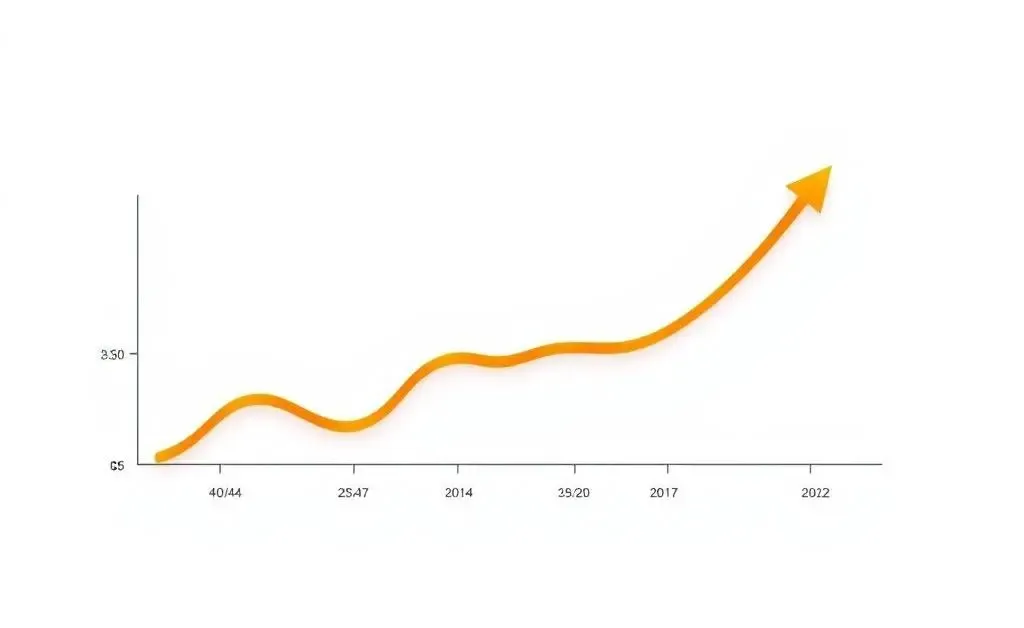

In recent years, India's economy has been a beacon of potential in Asia, characterized by rapid growth, a thriving middle class, and an emerging global influence. What's truly noteworthy is its diverse economic sectors, which house plenty of opportunities for those who know where to look.

Understanding Economic Indicators

Keeping an eye on key economic indicators can offer invaluable insights into which sectors might boom in the coming years. Look for trends in GDP growth, demographic changes, and sector-specific developments like advancements in technology or infrastructure investment. A deeper understanding of these elements can guide your investment choices.

The Sectors Worth Watching

It's one thing to be aware of a booming economy, and another to know where to actually invest. Here are some sectors in India that seem particularly promising:

- Technology: With the rise of digital platforms and services, tech remains a powerhouse. Keep an eye out for companies involved in data solutions, artificial intelligence, and cybersecurity.

- Green Energy: As India commits to sustainability, renewable energy ventures are gaining traction.

- Agriculture: Often overlooked, agri-tech solutions are modernizing this traditional sector, enhancing productivity and efficiency.

- Healthcare: There's a growing demand for accessible healthcare services, spurred by an increasing middle class.

How to Make Smart Decisions

Identifying potential winners isn't just about picking an industry. It's also about evaluating company fundamentals, market positioning, and management effectiveness. Personally, I like to tune into quarterly earnings and management discussion reports. They provide a snapshot of a company's current standing and future outlook. Don’t forget — always stay curious and be willing to adapt your strategies.

Stay Informed, Stay Agile

The secret sauce is a mix of staying informed and remaining agile in your investment approach. Subscribe to industry reports, follow influential thought leaders, and don't shy away from a bit of on-the-ground research. With the right strategy, navigating India's investment landscape can be much more rewarding.

So what do you think — ready to dive into India's promising market? What strategies or sectors are you personally excited about? Leave a comment below; I'd love to hear your thoughts!