How to Manage Money Wisely in Your 20s Without Feeling Restricted

Discover tips for budgeting and financial freedom while enjoying life in your 20s.

Ever feel like your paycheck disappears as soon as it hits your bank account? You're probably not alone. Managing money in your 20s can feel like walking a tightrope — balancing between saving for the future and enjoying the present. Let's dive into how you can manage your finances without sacrificing your social life!

Why Budgeting Matters

It's no secret that budgeting is crucial, but it's often misunderstood. Budgeting isn't about deprivation; it's about your priorities. Think of it like crafting a roadmap to reach your financial goals. This might include:

- Saving for emergencies

- Paying off student loans

- Investing for the future

- Enjoying hobbies and travel

Simple Tips to Get Started

Here's a practical approach to budgeting:

1. Track Your Spending

Before making any changes, know where your money goes. Use a simple app or good old spreadsheet to keep tabs for a month.

2. Create a Realistic Plan

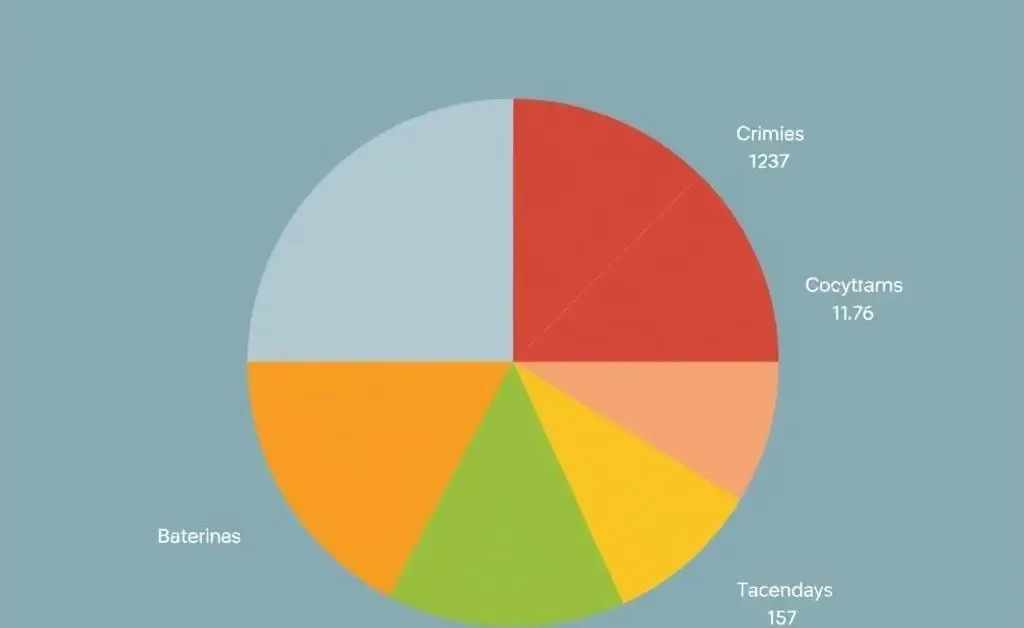

Base your plan on your tracking report. Start by categorizing expenses. A common framework is the 50/30/20 rule — 50% needs, 30% wants, 20% savings/debt repayment.

3. Stick to Your Plan

Once you have a plan, the hard part is following it without getting off track. Build flexibility into your budget for the occasional splurge.

4. Prioritize Again Every Few Months

Life changes, and so should your budget. Review and adjust as necessary.

Keeping It Fun

Worried budgeting will kill your social life? It doesn't have to! Here's how you can be frugal yet have fun:

- Host potluck gatherings instead of dining out

- Find free local events

- Explore nature trails or parks

Still not convinced? Meet Alex. Right out of college, Alex thought budgeting meant missing out on fun. But by the end of the month, Alex would always be broke, stressed, and unhappy. By prioritizing social spending and opting for creative, less expensive hangouts, Alex found the key to enjoying life without breaking the bank.

What's Your Next Step?

Leaving your 20s financially smart might be easier than you think. It's all about planning and prioritizing. So, are you ready to take control of your finances without giving up on the finer (or fun) things in life? What's one financial goal you want to achieve this year, and how will you start today?