How to Master Budgeting: A Step-by-Step Guide for Success

Learn budgeting essentials for financial success with practical tips and friendly advice in this easy-to-follow guide.

Are you tired of living paycheck to paycheck, or just unsure of where your money disappears each month? You're not alone. Many people struggle to get their finances in order, but mastering budgeting skills can change your financial future—and it's easier than you might think.

Understanding the Basics of Budgeting

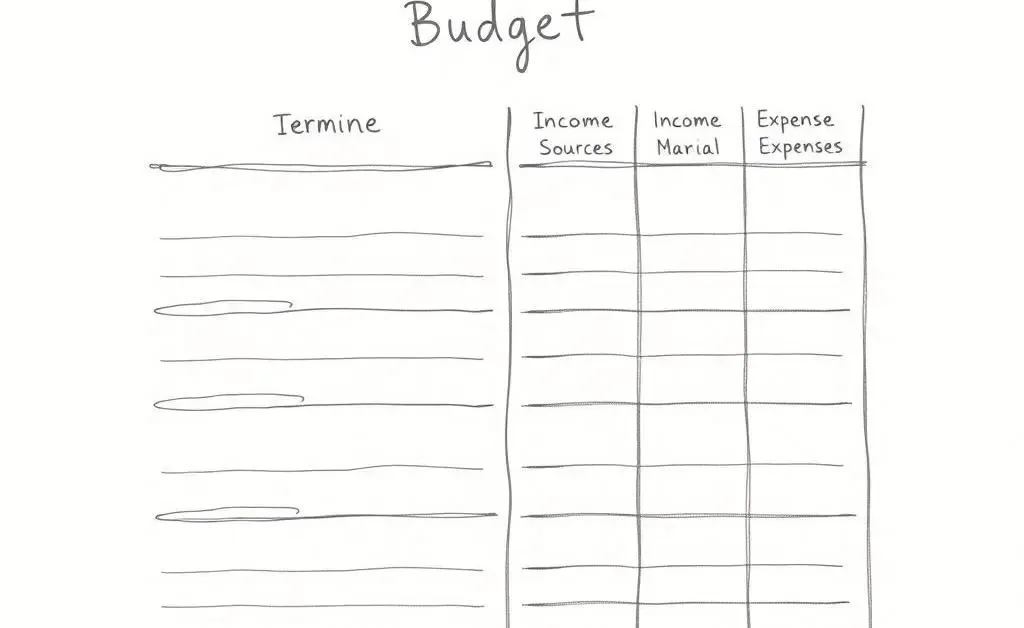

Budgeting isn't about restricting yourself; it's about understanding where your money goes and making sure it aligns with your financial goals. At its core, budgeting involves tracking your income and expenses.

- Start by listing all sources of income

- Document all expenses—fixed and variable

- Subtract expenses from income to see where you stand

Creating Your Personalized Budget

Once you have the basics down, personalize your budget by categorizing your expenses and setting spending limits. One popular method is the 50/30/20 rule. Allocate 50% of your income for needs, 30% for wants, and 20% for savings or debt repayment.

Here's a little story—imagine you’re like Jane, a teacher who found herself overwhelmed by unexpected expenses. By meticulously following her budget plan, she managed to save for a vacation while also building an emergency fund. Jane’s success started with understanding her spending habits.

Sticking to Your Budget

The key to any budget is consistency. Reassess your budget monthly and adjust as needed. Make use of online tools and apps that help track your spending in real-time. Being flexible and honest with yourself can make all the difference.

Long-term Financial Planning

Budgeting also sets the foundation for long-term financial success. Think about your future goals—buying a house, traveling, or retirement? Set up specific savings goals for each. For more detailed advice, check out resources like NerdWallet, which offers insight into savings and investments.

The journey to financial security begins with understanding your finances and making informed decisions. What budgeting strategies work best for you? Share in the comments below, and let's continue the conversation!