How to Navigate Car Loans When the Value Depreciates Faster Than Expected

Discover strategies to handle car loans wisely when facing negative equity.

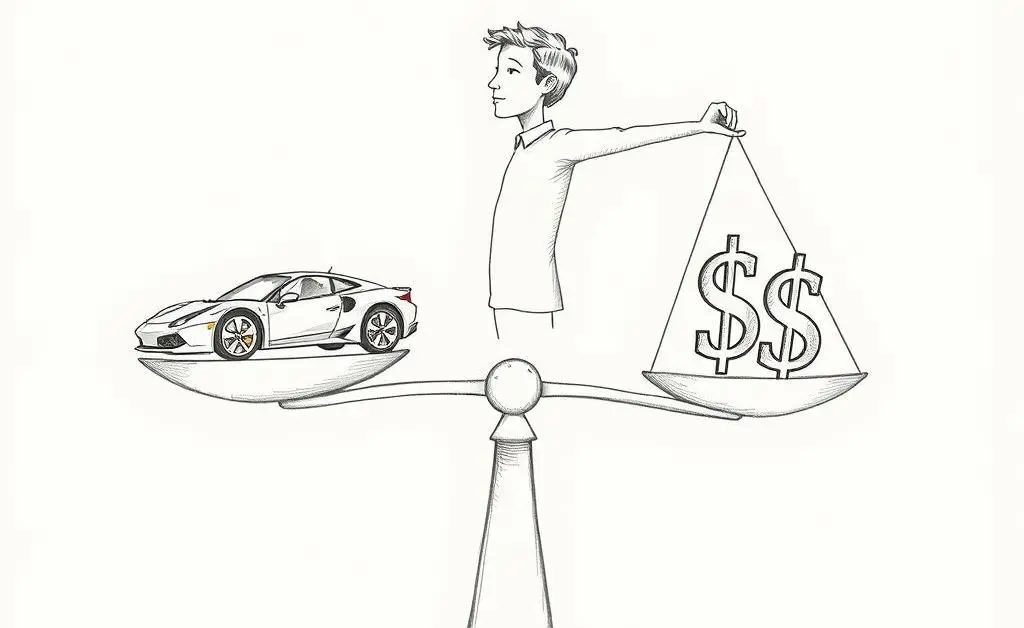

Have you ever found yourself bewildered by a car loan that outstrips the value of the vehicle itself? It's like paying for a meal you barely enjoyed while the tab keeps growing. Welcome to the world of auto loan depreciation, where the car you proudly drove off the lot is now worth less than the loan balance you owe. Let's break down how to smartly navigate this tricky territory.

Understanding Car Value Depreciation

First, it's crucial to understand why vehicles depreciate so quickly. Cars lose value the moment they're driven off the showroom floor, akin to buying electronics that become outdated rapidly. This depreciation is normal, yet it becomes concerning when it happens faster than loan repayment.

Assessing Your Situation

Your loan's weightiness doesn't have to feel unbearable. Here's a quick checklist to assess your current standings:

- Verify the current market value of your car

- Check the remaining loan balance

- Determine difference: Is it positive or negative?

Finding Steps Out of the Debt Cycle

Imagine this: a friend once shared their innovative solution when faced with a similar situation. They decided to refinance their loan, negotiating better terms and lower interest rates, which can sometimes make a dramatic impact.

Consider refinancing your loan or trading in your vehicle for a cheaper, more financially sustainable option. These approaches can ease your financial burdens while offering more predictable monthly payments.

Creative Solutions for Vehicle Loans

Your journey to financial freedom may include some creativity, just like adding a pinch of spice to a bland recipe. You might explore additional income sources such as freelance opportunities or overtime shifts. Alternatively, you may seek assistance from a reputable financial advisor to tailor a debt reduction plan that's just right for you.

Moving Forward with Confidence

Remember, at the heart of this journey is your resilience and adaptability. What other clever strategies have you discovered on your path to solving financial challenges? We’d love to hear your stories and the solutions that have transformed your own financial landscapes.