How to Navigate Financial Waters When Interest Rates Fluctuate

Understand how fluctuating interest rates can impact your finances and learn practical steps to sail smoothly.

Ever felt like your finances were hit by a rogue wave? When interest rates soar or dip, it can feel like being tossed around in a turbulent sea. But fear not! With a bit of planning and insight, you'll gain a steady grip on your financial ship.

The Impact of Interest Rates on Your Wallet

Interest rates can change in the blink of an eye, and so can their effect on your financial journey. Let's break down how these rates impact different aspects of your financial life:

- Savings: Higher interest rates often mean better returns on your savings accounts, while lower rates might dampen your earning spree.

- Loans and Mortgages: On the flip side, if you're eyeing a mortgage or personal loan, lower interest rates can reduce your payable amount significantly.

- Investments: Stock markets can react unpredictably to interest rate changes, affecting your investment plans.

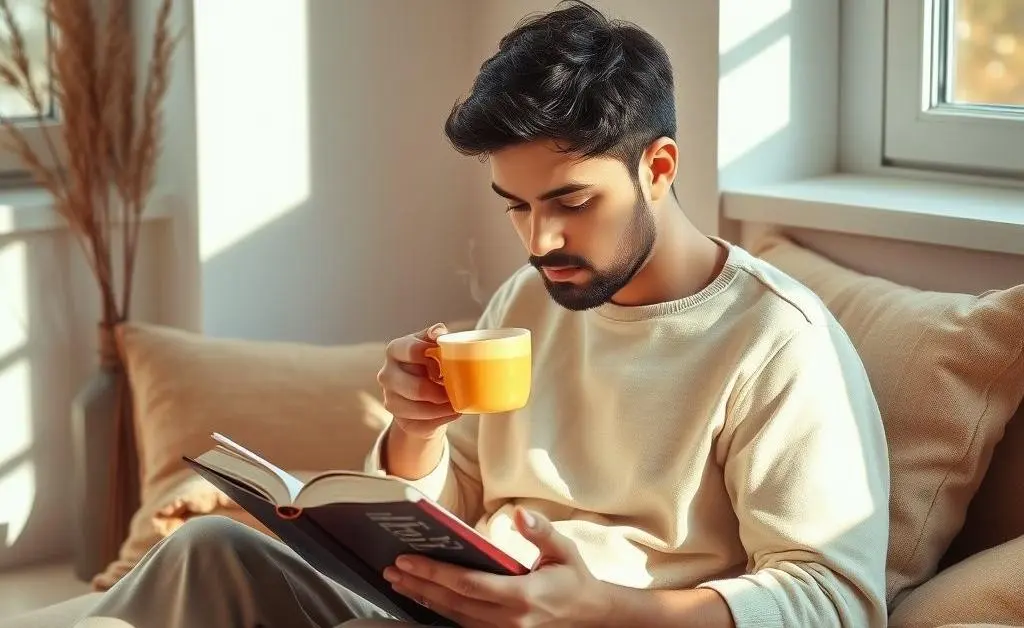

Personal Story: Finding Balance Amidst the Chaos

Let me tell you about my friend Alex. A few years back, he decided to take a plunge into the world of homeownership. Just as he was getting ready to finalize the mortgage, interest rates unexpectedly jumped a few notches, throwing his budget plans off-balance. Instead of panicking, Alex took a step back, reassessed his financial situation, and worked out a new plan, ensuring his fiscal sails were adjusted for the storm. Today, he's got a cozy home and a financial strategy that even a seasoned sailor would admire.

Strategies for Smooth Sailing

What can you do when interest rates are all over? Here are a few practical strategies:

- Diversify Your Investments: Spread your investments across different asset classes to balance risk and reward.

- Fixed vs. Variable Rates: For loans, consider a fixed rate to lock in current interest rates before potential hikes.

- Emergency Fund Cushion: Build up an emergency fund to cushion against unforeseen rate changes affecting your budget.

Conclusion: Chart Your Course

Navigating through the world of interest rates can be tricky, but with the right knowledge and tools, you can steer through financial uncertainties with confidence. Have you found any unique strategies to deal with fluctuating interest rates? I'd love to hear what you do to keep your financial ship on course.