How to Pick the Perfect Credit Card: A Friendly Guide

Discover how to choose the best credit card for your needs with our friendly and insightful guide.

Ever wonder how to pick the perfect credit card? You're not alone—it can feel like an overwhelming decision with so many options out there. Whether you're looking for travel rewards or just a simple card to build your credit, finding the right card is all about understanding your needs and habits.

Starting with Your Spending Habits

The first step to finding the ideal credit card is to assess your spending habits. Are you a frequent traveler, or do you mostly use your card for groceries and dining out? Understanding where you spend the most will help you choose a card that offers the best rewards for you.

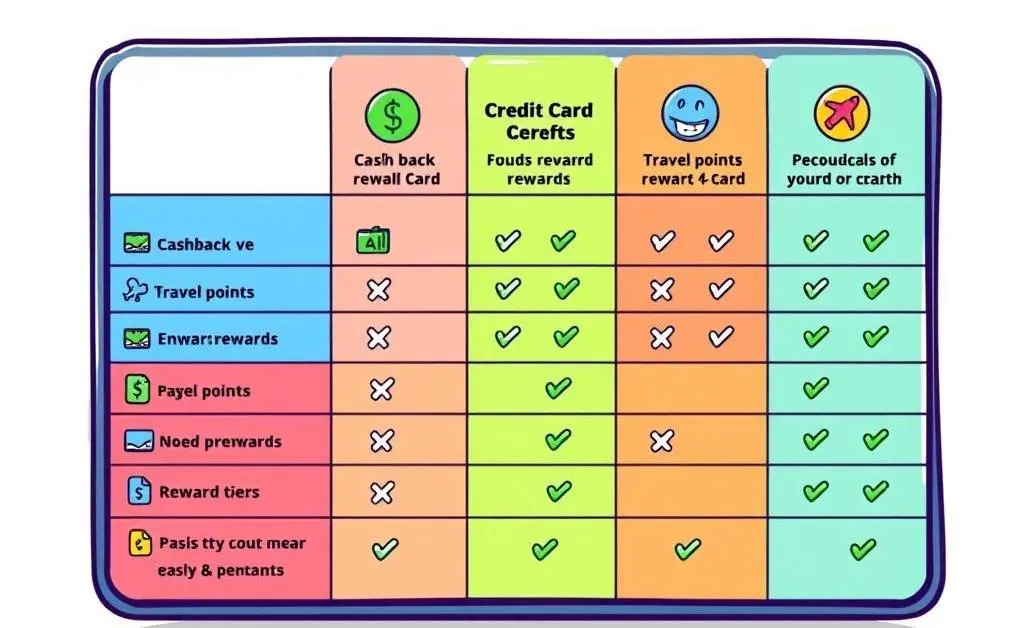

Things to Look For

- Rewards programs: Are they for travel, cashback, or points?

- Annual fees: Are the benefits worth the cost?

- Interest rates: Will you be carrying a balance?

- Sign-up bonuses: Are there any appealing introductory offers?

Balancing Fees and Features

Some cards come with enticing features like airport lounge access or concierge services, but they might also have high annual fees. Make sure the perks are worth the cost for you. One time, I signed up for a card with a hefty fee for the lounge access, only to realize I was traveling less than I thought!

Building or Rebuilding Credit?

If your goal is to build or rebuild your credit, start with a card that reports to all three credit bureaus. Some secured cards require a deposit, but they can be a great way to establish or repair your credit score. In no time, you’ll be eligible for more rewarding cards.

Responsible Card Use

Remember, while credit cards offer convenience and rewards, they're most effective when used responsibly. Paying off your balance in full each month and keeping your credit utilization low can help you maximize benefits without risking debt.

So, what features are most important to you when choosing a credit card? Is it the rewards, the fees, or perhaps the customer service? Share your thoughts in the comments; I'd love to hear what makes a card perfect for you.