How to Protect Your Credit Score in the Age of Big Data

Learn effective strategies to safeguard your credit score from being compromised by data brokers.

Hey there! If you're anything like me, you've probably found yourself baffled by the myriad ways our personal data floats around in the digital sphere. And you know what? It's not just about those pesky targeted ads—your credit score can be at risk too. Let me share some insights on how to secure your credit score from the prying eyes of data brokers.

Why Is Your Credit Score Important?

Your credit score isn’t just a number; it’s the key to financial opportunities. Whether you’re applying for a loan, a mortgage, or even certain jobs, your credit score paints a picture of your financial trustworthiness. A healthy score unlocks doors, while a poor one can close them tight.

How Credit Bureaus Obtain Your Data

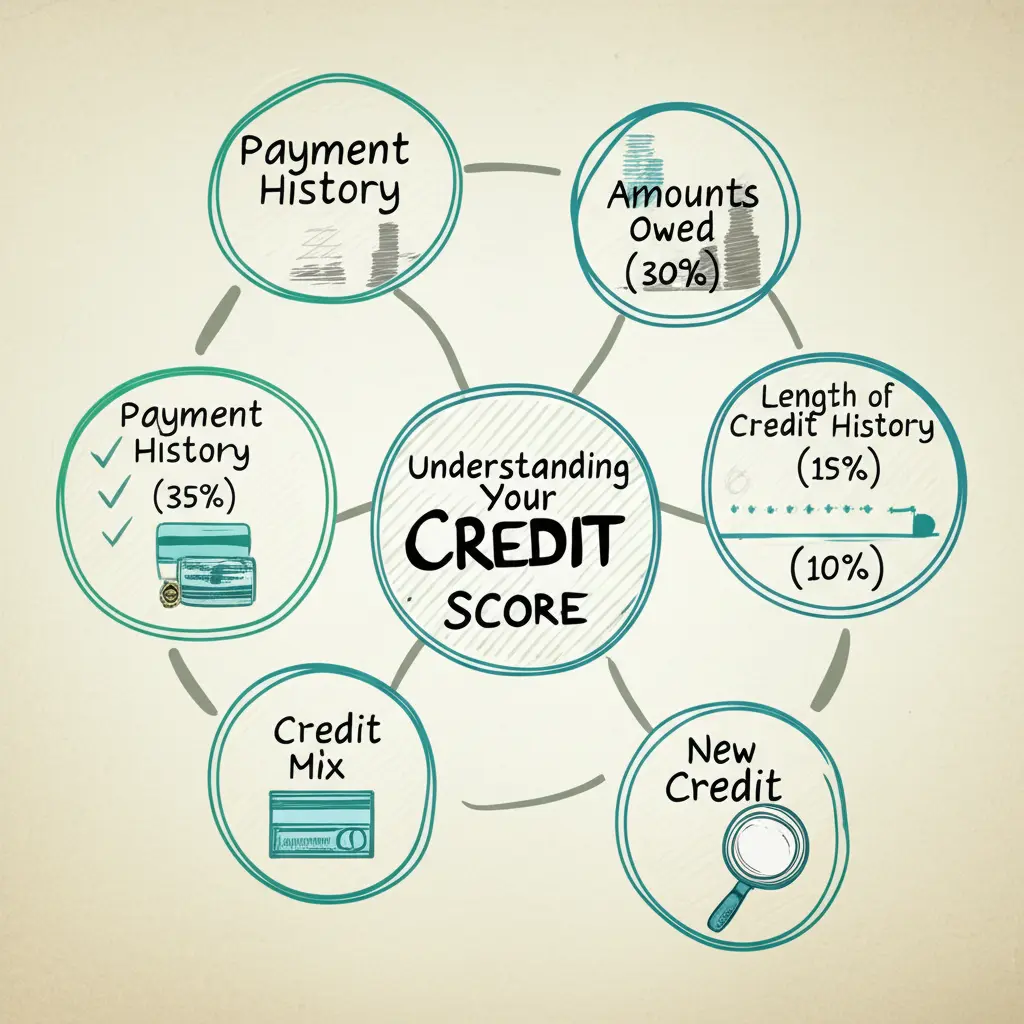

Let’s start with a quick rundown. Credit bureaus compile data about you, like your payment history and debt levels, from various sources. However, not all data collectors are playing by the same rules. Enter: data brokers.

These brokers aggregate and sell data to third parties, often without your explicit consent. They purchase data from apps, social media, and sometimes public records. The more they collect, the more they can affect what’s known about you—including insights that could influence your credit rating.

Steps to Safeguard Your Credit Score

Don’t fret! There are concrete steps you can take to protect your credit score against inaccuracies and unwanted access.

- Regularly Check Your Credit Report: Find and fix discrepancies by checking your free annual credit reports. Inconsistencies can flag problems early.

- Freeze Your Credit: When your credit is frozen, creditors can't access your report, preventing identity theft. It's a straightforward process most companies allow you to do online.

- Opt-Out of Data Broker Listings: While it’s virtually impossible to fully remove your data footprint, several services and brokers allow you to opt-out. It’s worth taking the time to safeguard yourself.

Stay Proactive

In the game of data and credit, proactivity is your best friend. The steps above won’t completely cage the data beast, but they'll certainly trim its claws. For what it's worth, I’ve found a peace of mind in staying one step ahead.

What’s your take on data security? Have you found any tactics particularly useful in guarding your financial metrics? Let’s continue the conversation!