How to Protect Your Personal Data When Buying a Home

Learn how to safeguard your personal data during the home-buying process.

Buying a home is both exciting and daunting. On one hand, you're embarking on a new chapter. On the other, you're diving into the deep waters of paperwork, financial checks, and, inevitably, the realm of personal data protection. Have you ever wondered how much of your info you're actually sharing when you sign on the dotted line?

Why Protecting Your Data Matters

Let me take you back a couple of years. A dear friend of mine, let's call him Mike, was over the moon about buying his first home. Everything was ticking along nicely until Mike started getting spammed with credit card offers and mysterious loans he never applied for. Turns out, his personal information was making its rounds among companies he never signed up for!

Here's the thing—when buying a home, you're required to provide sensitive information like your Social Security number, bank account details, and more. Protecting this info can prevent it from being mishandled or worse, falling into the wrong hands.

Protective Steps You Can Take

- Use Secure Channels: Always ensure your data is transferred via encrypted methods. This means using secure websites (look for "HTTPS") and encrypted emails.

- Limit Your Sharing: Only share what's absolutely necessary. Double-check what your realtor and loan officer need before handing over details.

- Regularly Monitor Your Accounts: Keep an eye on your bank statements and credit reports, especially during the home-buying process.

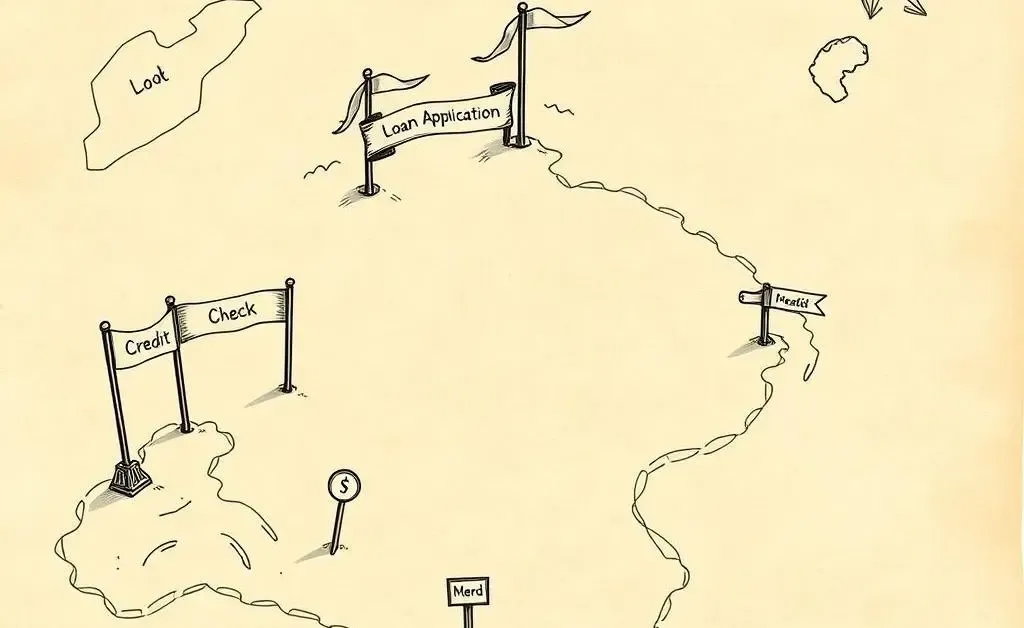

Handling Credit Agencies

During real estate transactions, credit agencies are often involved, providing lenders with your credit score and history. While essential, this involvement can lead to unwanted solicitations. One solution? Opt-out of prescreened offers. It's a smart way to minimize the influx of offers you're not interested in.

Signs of Potential ID Theft

While you're safeguarding your data, keep an eye out for red flags that could indicate identity theft:

If you start receiving unfamiliar bills or find charges on your statements you didn't make, act promptly. Contact your bank, the credit bureaus, and consider placing a fraud alert on your reports.

Curious if you're doing enough to protect your personal data while buying a home? Share your thoughts or questions below. Let's make your home-buying journey as safe and stress-free as possible!