How to Recover from Debt and Rebuild Your Financial Life at Any Age

Discover practical steps to overcome debt and regain financial confidence, no matter your age.

Hey there! If you're feeling overwhelmed by debt, especially at a young age, I want you to know you're not alone, and there are ways to climb out and rebuild your financial life. It might feel like the situation is hopeless, but with some practical steps and a proactive attitude, you can regain control.

Understanding Your Situation

Let's start by recognizing the importance of facing your debt head-on. It's easy to fall into the trap of ignoring our financial problems, but acknowledging them is the first step toward recovery. Begin by making a comprehensive list of what you owe, including any loans, credit card balances, and personal debts. Seeing the numbers on paper can be daunting, but it also empowers you to tackle them directly.

Creating a Manageable Budget

Next up, crafting a budget that accommodates your current expenses and allows for debt repayment is crucial. Start with a simple plan: list your income sources and necessary expenses—think rent, food, and bills. Then, identify areas where you can cut back. Remember, every little bit helps!

Automate and Prioritize Payments

Consider setting up automatic payments for your debts. Prioritize those with the highest interest rates first, as this will save you money in the long run. Many banks offer easy options for automating payments, helping you stay consistent.

Seeking Professional Advice

Sometimes, a fresh perspective from a professional can make all the difference. Financial advisors or credit counseling services can provide personalized advice tailored to your situation. They often have insights that might not occur to you and can negotiate with creditors on your behalf.

Building a Savings Cushion

While paying off debt is priority number one, don't neglect the importance of savings. Even a small emergency fund can save you from falling back into debt if unexpected expenses arise. Consider setting aside a small amount each month to build your cushion gradually.

Reflecting on Lifestyle Changes

Dealing with debt often forces us to re-evaluate our lifestyle choices. Perhaps splurging on unnecessary items isn't as appealing as working towards financial freedom. Shifting your perspective can be liberating—more control over your finances often leads to a happier, more stress-free mindset.

Looking Forward to Financial Stability

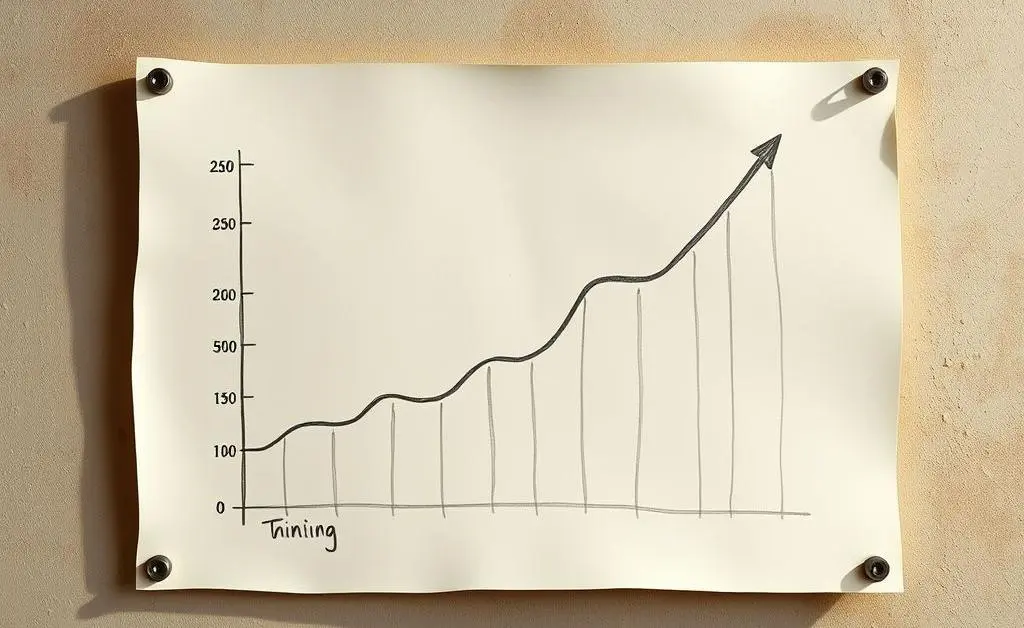

Lastly, remember that this is a journey, and progress takes time. Celebrate the small victories along the way, as each one brings you closer to your goal. Imagine a future where you're debt-free, and use that as motivation to keep pushing forward.

Have you faced financial challenges, and how did you overcome them? Sharing your journey can not only help others but also serve as a reminder of how far you've come. So, what steps will you take today to improve your financial future?