How to Remove a Collection from Your Credit Report: Practical Steps for a Better Score

Discover effective ways to remove collections from your credit report and boost your credit score.

Ever open your credit report and wonder why that pesky collection is still there? Spoiler alert: it's not supposed to be permanent! Removing a collection from your credit report isn't magic, but it can feel like a superhero move that improves your financial future. Let's unravel this mystery together!

Why Do Collections Impact Your Credit Score?

First, let's decode why collections appear on your report in the first place. When credit accounts like a credit card or loan are unpaid for a lengthy period, they're often handed over to a collection agency. Unfortunately, these collections can significantly dent your credit score. Yikes! But don’t worry—ridding yourself of this blemish is doable.

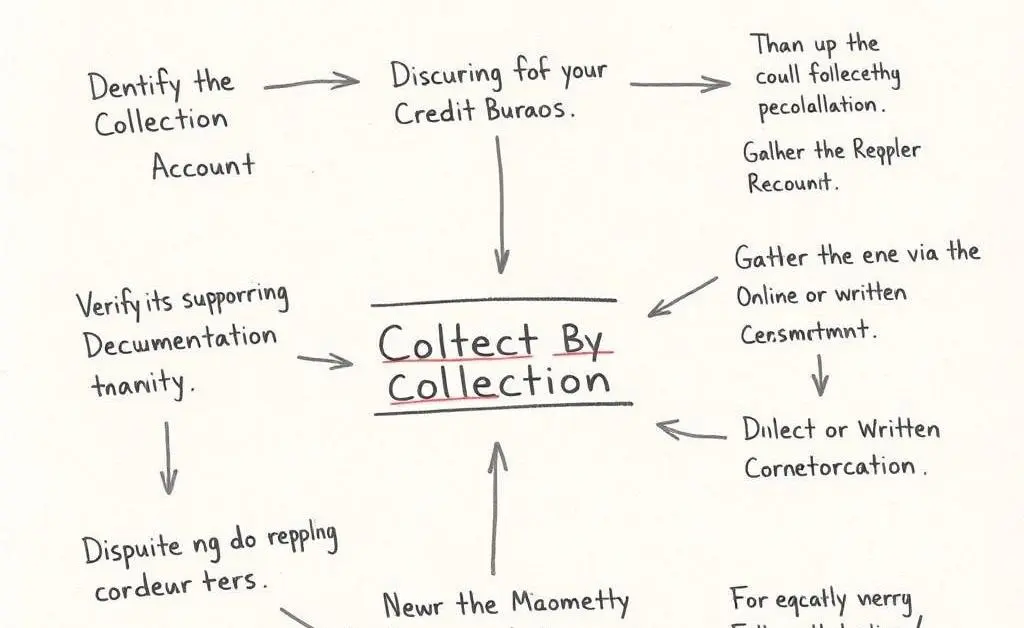

Steps to Remove a Collection

Ready to banish that collection? Follow these steps:

- Verify the Debt: Request a written validation of the debt. Confirm everything matches your records.

- Negotiate a Pay-for-Delete Agreement: Offer to pay, if you can, in exchange for removing the collection.

- Dispute with Credit Bureaus: If there's an error, loop in the credit bureaus to investigate.

- Request Goodwill Deletion: Politely ask for mercy from the agency—it works sometimes!

These strategies can sometimes sound like trying to slay a dragon with a spoon, but many have succeeded!

A Real-Life Anecdote

Let’s talk about Sarah, who thought she'd be stuck with her collection forever. After a little legwork, she mailed a goodwill deletion letter explaining her situation when she missed a few payments due to medical bills. To her surprise, the agency removed the collection! So, it’s worth a try—Sarah can vouch for that!

The Power of Patience and Persistence

Remember, Rome wasn't built in a day, and neither is a pristine credit score. As you embark on this journey, keep cool—and persistent!

What's Next for You?

Now that you’ve got the tools to tackle collections head-on, give it a go! If you’ve already tried, what strategies did you find most effective? Let us know in the comments below or, better yet, share a success story to inspire others on the same path.