How to Safeguard Your Credit: Tips Beyond the Basics

Learn how to effectively protect your credit in today's complex landscape.

Did you know that nearly 30% of Americans have errors on their credit reports? That’s kind of like discovering broccoli in your ice cream—unwanted and not what you signed up for. In today's digital age, safeguarding your credit is more than just a nice-to-have; it's a must. But where do you even start? Let’s break it down.

Start with the Basics: Check Your Credit Report Regularly

Reviewing your credit report is like peering under the hood of your personal finances. You can request a free report once a year from each of the three major credit bureaus through AnnualCreditReport.com. Make sure everything is accurate. If you find discrepancies, don’t panic. Follow up with the credit bureau to correct the errors.

Get Alerts for Peace of Mind

Ever get those middle-of-the-night anxiety jitters? Set up alerts through your bank or credit card provider to notify you of suspicious activity. This minimizes the risk of fraud going unnoticed.

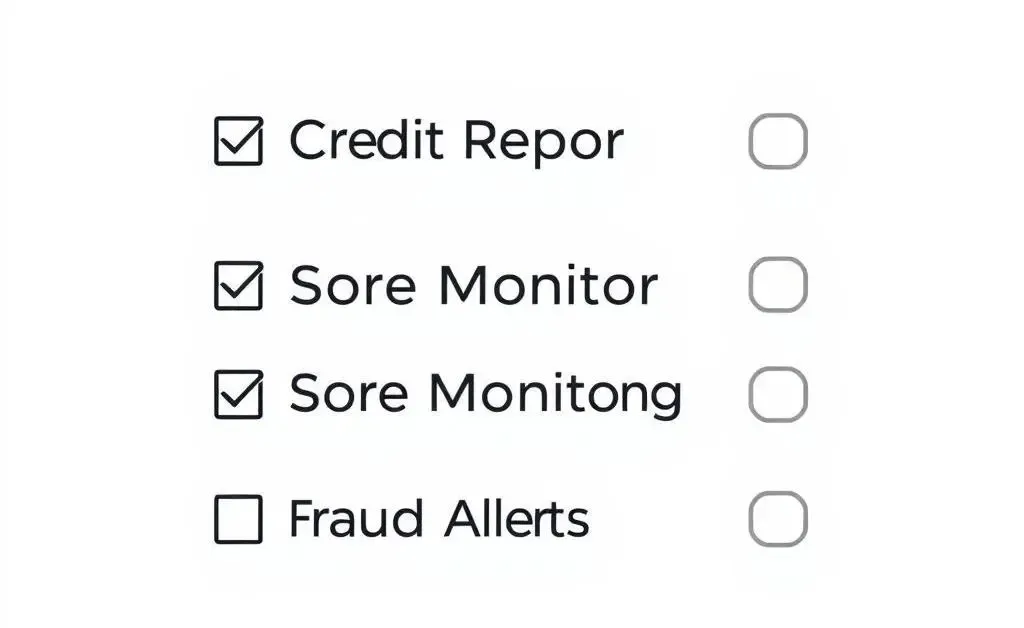

Expand Your Toolbox: Consider Credit Monitoring Services

Beyond your own checks and balances, credit monitoring services can act as an additional line of defense. They’ll notify you of any changes in your credit report or score. Some available services even offer identity theft insurance. Sure, it’s another subscription, but it’s also peace of mind for your financial health.

- Automated alerts for unusual activity.

- Identity theft insurance.

- Regular monitoring of your credit score.

Freeze It to Thaw Your Worries

Think of a credit freeze as your last line of defense. This is your 'hacker-proof' door, preventing anyone from accessing your credit without permission. If you’re not planning on applying for new credit any time soon, it’s a simple yet effective option.

A Little Story to Ponder

Imagine your friend Alex, who thought he was quite smart with his money management. One day, he received a mysterious bill for a flashy gadget he never purchased. Panic ensued! Luckily, he'd set up all the monitoring systems we discussed, so he was able to resolve the issue efficiently. Alex's story is just one of many, but it emphasizes the importance of being prepared.

Protecting your credit doesn’t have to be daunting. With a little effort and the right tools, you can keep your credit intact and your mind at peace. How do you plan to protect your credit today?