How to Tackle Credit Card Debt and Regain Financial Freedom

Practical tips to manage and pay off credit card debt efficiently.

How to Tackle Credit Card Debt and Regain Financial Freedom

Feeling overwhelmed by credit card debt can be stressful, but the good news is there's a way forward. Whether your debt has been quietly accumulating or appeared after unexpected expenses, you can take control and find relief. In this guide, I'll share straightforward, practical steps to help you manage your debt more effectively and work towards financial freedom.

What Causes Credit Card Debt?

Understanding the root causes of your credit card debt is essential. Debt can arise from various sources — impulsive purchases, covering basic needs during tough times, or even medical emergencies. Identifying the 'why' behind your debt can help you address the underlying issues and prevent future pitfalls.

Step 1: Assess Your Debt Situation

Before diving into solutions, take a clear inventory of your debt. Gather all your credit card statements and note down important details: the balance owed, interest rates, and minimum monthly payments.

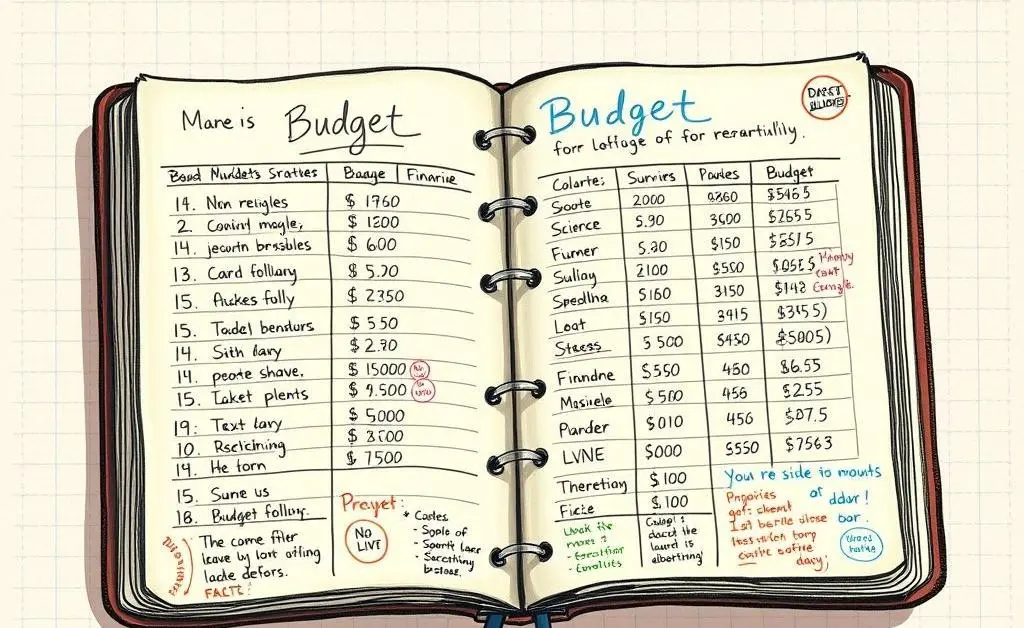

Step 2: Create a Realistic Budget

Developing a budget can be a game-changer. It serves as a roadmap for your financial journey, helping you allocate funds wisely and cut unnecessary expenses. A simple budget setup might include listing all income sources and categorizing spending areas.

Step 3: Choose a Debt Payment Strategy

There are various strategies to tackle your debts. Two popular methods include:

- Snowball Method: Focus on paying off your smallest debts first while making minimum payments on others, gradually building momentum.

- Avalanche Method: Prioritize paying off debts with the highest interest rates to save on interest payments over time.

Choose the method that best fits your situation and personality.

Step 4: Consider Lowering Interest Rates

High interest rates can quickly inflate your debt, making it harder to pay down. Consider calling your credit card company to negotiate better rates or explore balance transfer options to cards with lower interest.

Step 5: Build a Debt-Free Fund

As you begin to manage your debt, consider setting aside a small amount each month towards a savings fund labeled 'Debt-Free.' This fund acts as a financial cushion, preventing you from relying on credit for unexpected expenses.

Conclusion: Reclaiming Your Financial Freedom

While tackling credit card debt might seem daunting, remember that each step you take brings you closer to financial freedom. By understanding your debt, organizing a budget, selecting an effective payment strategy, and managing interest rates, you're building a secure financial future. Ready to get started? Share your first steps towards becoming debt-free below!