How to Wisely Invest $400,000: Smart Strategies for Every Investor

Discover savvy ways to invest $400,000 with this practical guide to smart & diversified strategies.

Making the Most of Your $400,000

You've come into $400,000 and you're looking to make it grow. It's a fantastic position to be in, but it also comes with a crucial question: How do you invest such a substantial amount wisely? The key is diversification, patience, and understanding your tolerance for risk. Let's explore some strategies that align with different financial goals.

Understanding Your Risk Tolerance

Before diving into any investment, it's essential to consider how much risk you're comfortable with. Are you someone who can sleep soundly during a market dip, or does a volatile market make you anxious? Understanding this will help tailor your investment portfolio to suit your comfort level.

Diversifying Your Investment Portfolio

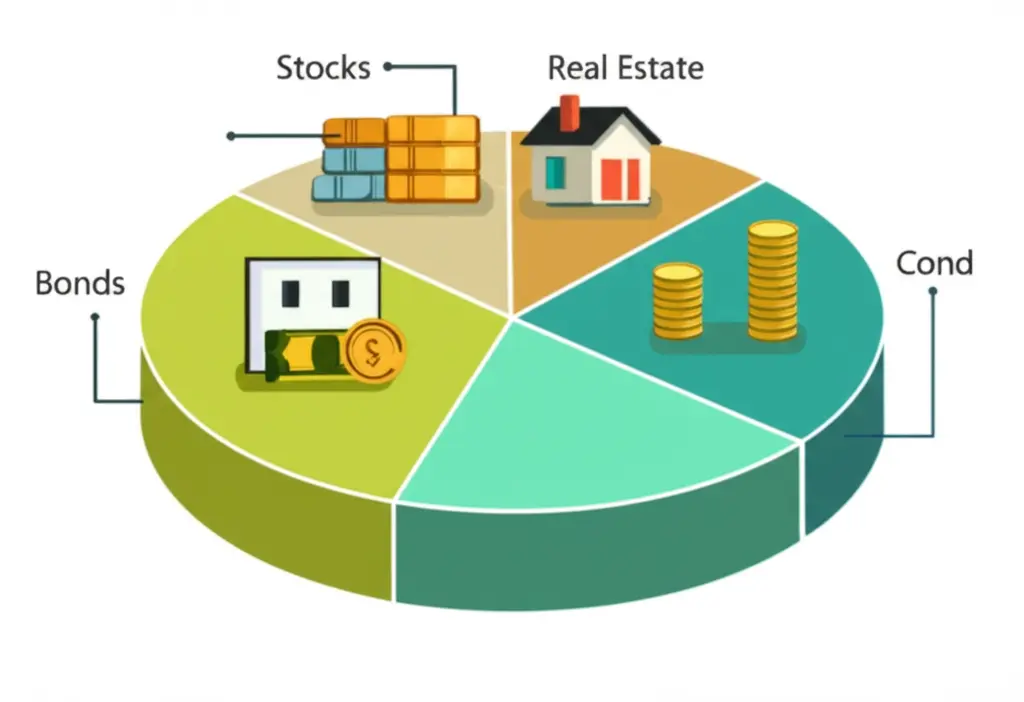

A well-diversified portfolio might include a mix of stocks, bonds, and real estate. By spreading your investments across different asset classes, you minimize the risk of losing it all if one sector performs poorly.

Stocks: Consider allocating around 40–60% of your portfolio to stocks. They're great for long-term growth, especially if you invest in a mix of established companies and promising startups.

Bonds: Bonds are generally more stable than stocks and can offer a steady income stream. You might allocate 20–40% of your portfolio here, depending on your risk tolerance.

Real Estate: Real estate can be a fantastic way to generate passive income. Whether it's direct property ownership or investing in real estate investment trusts (REITs), consider allocating 10–20% of your portfolio.

Setting Long-Term Goals

Investing is not a sprint; it's a marathon. Setting clear, long-term financial goals will guide your investment strategy. Whether it's retirement planning, buying a second home, or starting a business, having objectives will keep you focused.

Staying Informed and Flexible

The investment world is ever-changing, so it's crucial to stay informed. Regularly reviewing and adjusting your portfolio ensures you adapt to market shifts and capitalizes on new opportunities. As you gain more experience, you might find yourself becoming more comfortable with a higher risk-reward ratio.

Conclusion: Start Your Investment Journey Wisely

Investing $400,000 opens a world of opportunities. By knowing your risk tolerance, creating a diversified portfolio, and setting clear goals, you'll be well on your way to financial growth. What's one investment strategy you wish you knew earlier?