Investing for Beginners: Starting with the Basics

Explore foundational investing tips for beginners to grow wealth smartly.

Hey there! If you're new to the investing world, you're not alone—it can feel like stepping into another galaxy. You're probably wondering how to start investing and make sure your money works smarter for you instead of just sitting in a savings account. Here's a friendly guide to help you dive into investing with confidence.

Why Start Investing?

One of the biggest questions beginners have is why they should invest in the first place. Aren't stock markets risky? Well, that depends on how you approach it. Investing allows your money to grow over time thanks to the power of compound interest and opening doors for financial independence down the road.

Building Your Investment Portfolio

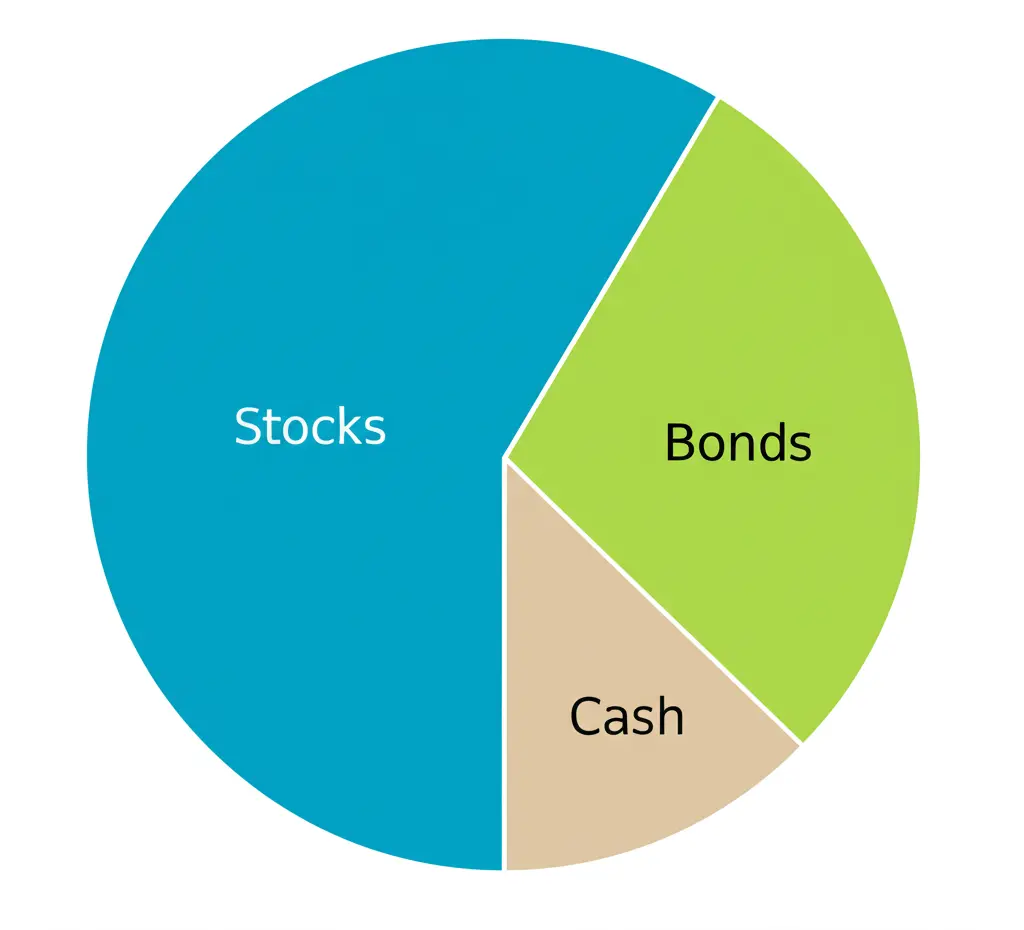

Here's where things can get exciting. Your investment portfolio is like a toolbelt crafted to work for your unique needs and goals. A diversified portfolio typically includes a mix of stocks, bonds, and cash to manage risk while aiming for a good return.

Setting Your Financial Goals

Before diving in, consider what you want from investing. Are you saving for a house, retirement, or maybe a dream vacation? Setting clear financial goals helps you determine the best type of investments to reach them. Often, long-term goals align well with stock market investments, which historically provide higher returns than cash savings.

Learning the Basics: Stocks and Bonds

Understanding the difference between stocks and bonds is crucial. Stocks represent ownership in a company, and successfully picking stocks can lead to substantial returns. Bonds are essentially loans to a company or government and generally offer lower risk and returns. A mix of both can help stabilize your portfolio.

Why You Need a Long-Term Strategy

Investing isn't about quick wins; patience is your greatest ally. The market tends to rise over the long term, despite short-term fluctuations. Committing to a long-term strategy can help you ride out inevitable downs and focus on your financial horizon.

Final Thoughts

Dipping your toes into investing can be both thrilling and daunting. The key is to start small, keep learning, and adjust your strategy as your understanding grows. What's your biggest question about starting to invest? I'd love to hear!