Investing for Your Family's Future: A Heartfelt Guide

Secure your family's future with practical investment tips in this engaging guide.

Creating a Secure Future for Your Loved Ones

Have you ever found yourself pondering how to best secure your family's future financially? It's a question that plagues many of us, especially when we want to make sure our loved ones are taken care of. In today's world, making intelligent investment decisions can be overwhelming, yet tremendously rewarding.

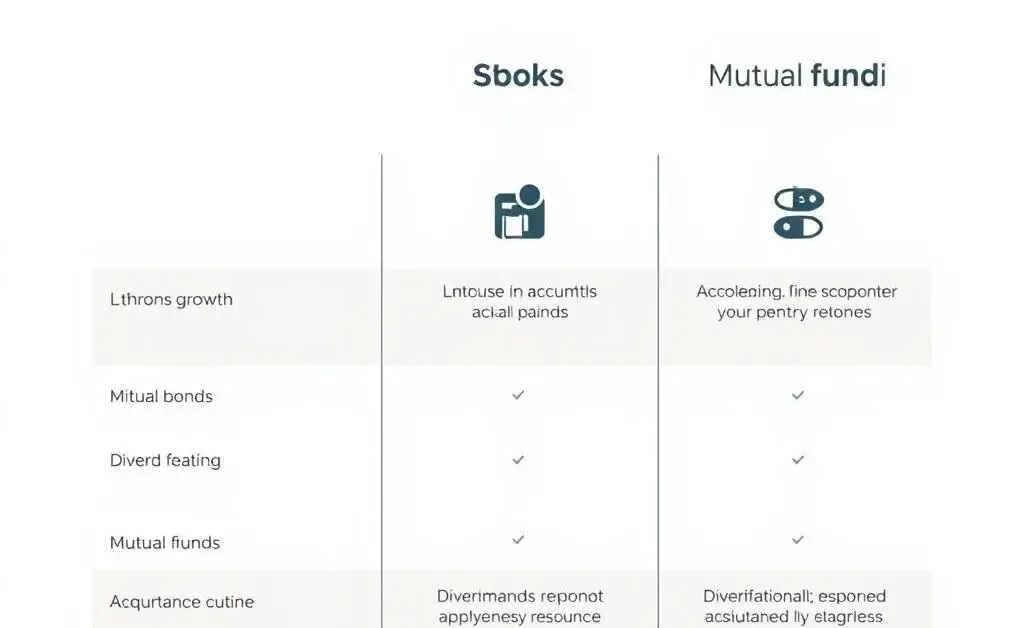

Understanding Your Investment Options

Let's begin by exploring a variety of investment options that form the backbone of any solid financial plan:

- Stocks: Investing in companies for potential high returns.

- Bonds: A safer, steady return option that involves lending money to governments or corporations.

- Mutual Funds: A diversified choice, pooling money to invest in multiple stocks and bonds.

Each option comes with its risks and rewards, so understanding them is essential for your peace of mind.

Personal Story: A Lesson from Home

Allow me to share a quick story. My father, a meticulous planner, always emphasized the importance of saving. When I was younger, every month he would sit at his favorite corner table, poring over our family's finances. From that, I learned a significant lesson: financial planning doesn't just affect your present; it's a gift to your future.

Practical Steps You Can Take

To begin your journey in ensuring a stable future, here are some practical steps:

- Consult a financial advisor for tailored advice.

- Diversify your investment portfolio to spread risk.

- Stay informed about market trends and economic news.

Wrapping Up: What's Your Financial Story?

Investing smartly for your family's future is not only about numbers and market studies; it's a heartfelt journey through which you can weave the values of security and foresight into your loved one's lives. What stories could unfold if you took your first step today?