Investing in Nuclear Energy: A Guide to ETFs Through Fidelity and Vanguard

Discover how to invest in nuclear energy ETFs using Fidelity or Vanguard for a smart, eco-friendly portfolio.

Investing always comes with its fair share of questions and concerns, especially when it comes to sectors you're not too familiar with. Lately, I've heard many conversations about the potential of nuclear energy ETFs and how one might go about investing through popular platforms like Fidelity or Vanguard. So, let's dive into this topic together, shall we?

Why Consider Nuclear Energy ETFs?

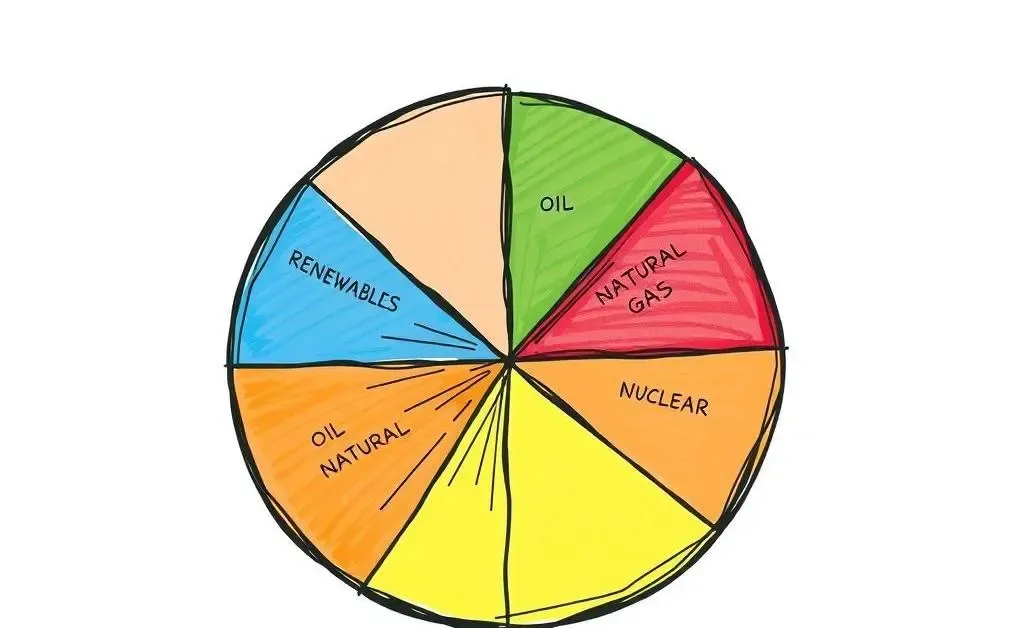

First things first, nuclear energy has actually been around for quite some time. It offers a low-carbon alternative to fossil fuels, making it a compelling option for those looking to green their investment portfolio. Plus, with advancements in technology and safety measures, it's becoming increasingly efficient and safer.

What Are ETFs and Why They're a Good Bet?

ETFs, or Exchange Traded Funds, are a set of securities you can buy or sell on an exchange, just like a stock. They offer diverse exposure to various industries or sectors, which in this case, is nuclear energy. It feels like having a buffet rather than a single entrée—more choices, less risk!

Navigating Fidelity and Vanguard

If you're like me, you appreciate simplicity, which is why Fidelity and Vanguard are often top choice platforms for investing. Both offer user-friendly interfaces and a variety of options for ETFs.

- Fidelity: This platform offers flexibility, with detailed research tools and educational resources to help you make informed decisions. Their fee structures are competitive too, which is always a plus!

- Vanguard: Known for their low expense ratios, Vanguard is perfect if you’re looking to keep costs low over the long term. They also have a solid reputation for integrity and customer service.

Pros and Cons of Investing in Nuclear Energy ETFs

| Pros | Cons |

|---|---|

| Environmentally friendly | High initial costs |

| Long-term growth potential | Political and public perception risks |

| Diversification within the energy sector | Potential regulatory changes |

Finding Your Path

Ultimately, whether you choose Fidelity, Vanguard, or another platform, what's important is finding a path that aligns with your financial goals and sustainable investing strategies. Take your time to research, start small, and don't hesitate to ask for expert advice when in doubt.

And there you have it—a beginner's look into investing in nuclear energy ETFs via reliable platforms. If you’re interested in responsible investing with promising future potential, this might just be your opportunity to diversify your portfolio in exciting ways.

Are you considering nuclear energy ETFs for your investment strategy? I'd love to hear your thoughts or any questions you might have in the comments below!