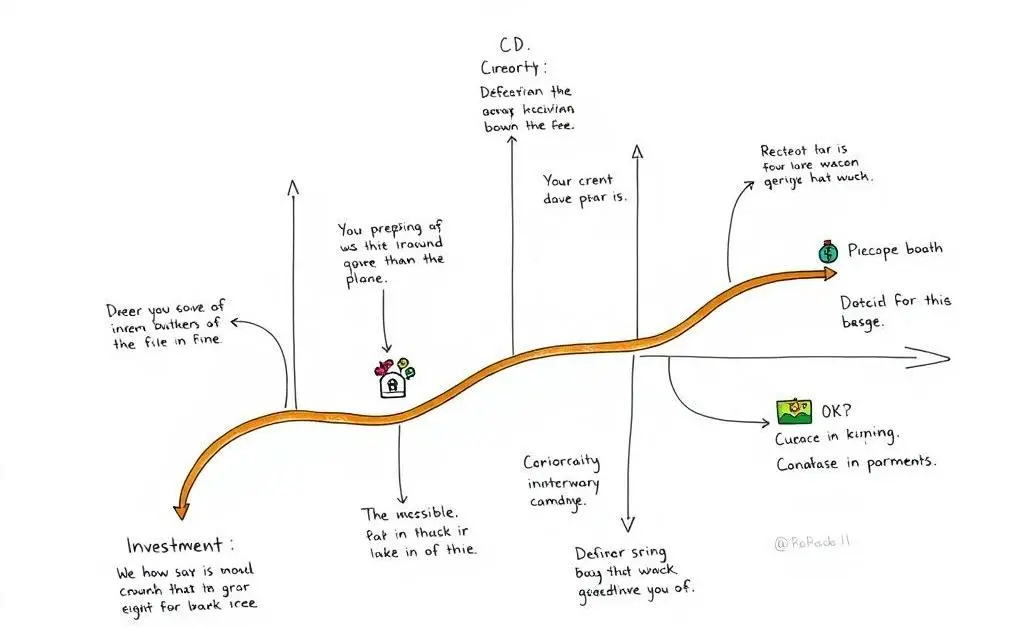

Is Investing in CDs the Right Move for Your Financial Journey?

Explore whether investing in CDs aligns with your financial goals and strategy.

Have you ever found yourself sipping tea and pondering about whether it's time to dip your toes into the world of investments? We've all been there, curious about different options that promise to secure our financial future.

Certainly, one of the less daunting avenues to explore is investing in Certificates of Deposit, often simply referred to as CDs. But how do we know if this is the right choice for us during a cozy afternoon financial planning session? Let's unravel this together, shall we?

Understanding the Basics of CDs

Before we take any leap, it's crucial to grasp the essence of CDs. Think of Certificates of Deposit as a savings option with a predetermined fixed term and interest rate. When you invest in a CD, you're essentially lending your money to a bank for a specific timeframe, and at the end, you get your principal back along with some extra interest.

What's comforting here is the promise of a fixed interest, which remains unaffected by market fluctuations—a lovely thought when the world of stocks seems as unsettling as a teetering teacup!

Weighing Risks and Returns

Remember, though, there's a trade-off involved. The higher safety offered by CDs often means lower returns compared to other investment vehicles like stocks or mutual funds. While it's nice to have those guaranteed returns, it might not line up with the lofty goals of someone looking for aggressive growth.

If you're like me and treasure peace of mind, then maybe a CD could play a part in your wider financial strategy—a bit of safety nestled comfortably among more adventurous options.

Is a CD Right for You?

It's all about personal goals and circumstances. If you're considering CDs, ask yourself:

- Timeframe: Can you afford to lock away funds for the term length?

- Risk Tolerance: Do guaranteed returns outweigh potentially higher, yet unstable, stock market gains?

- Financial Goals: Are you saving for a short-term purpose like a car or a holiday, or something more grand like retirement?

Reflecting on these questions can illuminate the path that feels right for you.

Blending CDs into Your Financial Plan

Incorporating CDs into a balanced portfolio can be as comforting as your favorite brew—it provides stability. Consider them as a diversification component, allowing for a mix of low-risk security while you explore other investment options with higher yield potentials.

Remember, there's no one-size-fits-all in financial planning. Your strategy should mirror your unique narrative—goals, risk appetite, and personal circumstances. Engaging with a financial advisor can further tailor this journey to fit like a glove.

As you mull over the possibility of adding CDs to your financial toolkit, perhaps while indulging in a warm cup of chamomile, ask yourself—what brings you closer to your dreams and keeps you at ease?