Is That Store-Specific Credit Card Really Worth It?

Explore the pros and cons of store-branded credit cards and how they impact your finances.

Alright, let's dive in! You're standing in line at your favorite store, and just when you least expect it, the cashier offers you a store credit card. The promise? Discounts, rewards, and sometimes, an exclusive welcome bonus. But is getting a store-branded credit card actually worth it? That's what we're here to figure out today.

What Are Store-Specific Credit Cards?

Store-specific credit cards are exactly what they sound like—credit cards that you can use exclusively at a particular retail chain. On the surface, they can seem like a sweet deal if you're a frequent customer. But there are a few things to consider before jumping in.

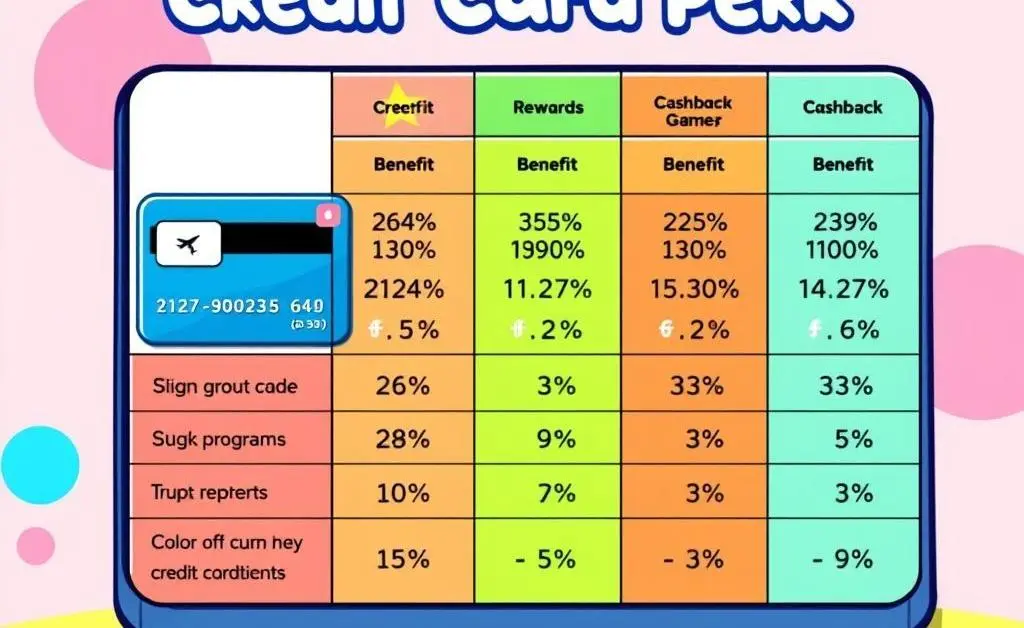

Pros of Store-Branded Cards

- Instant Discounts: These cards often come with immediate discounts on your purchase as soon as you sign up. It's tempting when you're looking to save some cash on your current shopping trip.

- Rewards Points: Accrue points for every dollar you spend, which can be redeemed for future savings, exclusive deals, or even freebies.

- Special Financing Offers: Some cards offer 0% financing for a certain period, which can be useful for larger purchases.

Cons You Need To Know

- Higher Interest Rates: Store cards tend to have higher interest rates compared to general-use credit cards. If you don't pay off your balance each month, the interest can stack up fast.

- Limited Use: As these cards are store-specific, their use is typically restricted to a single retailer.

- Impact on Credit Score: Opening new credit lines affects your credit score. Plus, high balances on a store card can increase your credit utilization ratio.

Should You Get One?

Ask yourself a few questions first: How often do you shop at this store? Are you disciplined enough to pay off your balance monthly? Is the card's interest rate sustainable for your budget?

If you're an avid shopper, a store card might be beneficial. However, if a higher interest rate is a concern, it might be better to stick with a general credit card that offers similar rewards without the caveat of limited usage.

The Bottom Line

In the world of personal finance, it's all about knowing yourself and your shopping habits. Store credit cards can offer value, but only if you're able to manage them responsibly.

Interested in learning more about maximizing your credit card benefits? Check out resources like Investopedia's guide on store credit cards for expert insights.

Have you ever signed up for a store-branded card? What was your experience like? I’d love to hear your take in the comments!