Journey to Financial Independence: Taking the Plunge After Losing a Job

Losing a job can be liberating. Discover how to navigate this change towards financial independence.

Ever faced that moment of sheer panic and strange relief when you suddenly find yourself without a job? I know I have, and it can feel like standing at the edge of a cliff, peering into the unknown. But here's the twist—sometimes, losing a job doesn't have to be the end of your world but the beginning of a new adventure. This could be your opportunity to navigate the path toward financial independence. Let me share some insights on how to turn this challenge into a triumph.

Assess Your Financial Landscape

The first stop on this journey is to take a long, honest look at your finances. Don't worry, this doesn't have to be a daunting task. Start by reviewing your current budget. What's your monthly expenditure? How long can your savings last? Understanding where you stand financially will help you make informed decisions about your next steps.

Embracing New Job Opportunities

Okay, so you’re no longer sporting your 9-to-5 badge. But guess what? That's a golden ticket to explore other opportunities. Have you ever dreamed of freelancing or starting a business? Now's the time to consider what kind of work you truly enjoy and how you might make a living from it. Explore platforms for freelancing or remote work. This newfound flexibility might be your gateway to a balanced work-life scenario.

Building Financial Security

Pursuing financial independence is about more than just quitting the corporate grind. It’s about crafting a lifestyle that aligns with your values and gives you the freedom to choose. This might include cutting unnecessary costs, increasing your savings, and making smart investments. Think about passive income streams like dividend stocks, rental properties, or side gigs that require little maintenance yet yield benefits over time.

The Bigger Picture: Setting Your Own Milestones

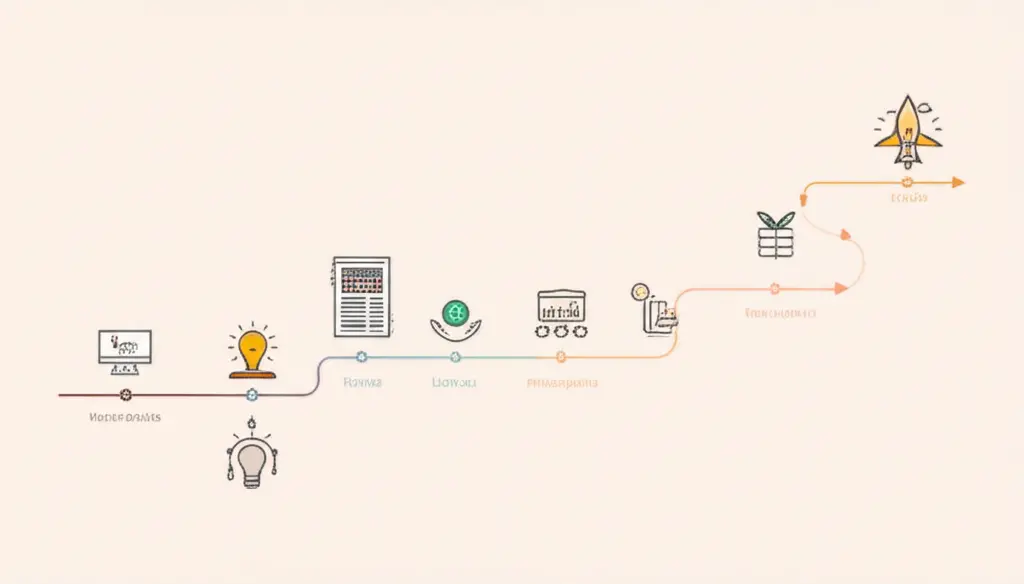

Ready to visualize your path? Imagine a roadmap to your financial goals with clear milestones along the way. Whether reaching a savings target, paying off student loans, or funding a dream project, setting achievable milestones gives clarity and motivation.

Take it from someone who's been there—losing your job can be unsettling, but it's also an invitation to reassess and realign your life with what truly matters to you. So, have you faced a similar crossroads? What did you learn from it? Share your thoughts or plans; I’d love to hear your story.