Juggling JEPI and SCHD: A Personal Dive into Dividend Investing

Explore JEPI vs SCHD for dividend investing with personal insights and practical advice.

Hey there, ever found yourself wrestling with the idea of choosing between JEPI and SCHD for your dividend investing journey? You're not alone. It's something I've pondered myself. Both offer different routes to that financial hilltop we all dream about, but which one's the right path for you? Let’s dive into this mystery together and see what we unravel.

Why Are JEPI and SCHD Attracting Eyes?

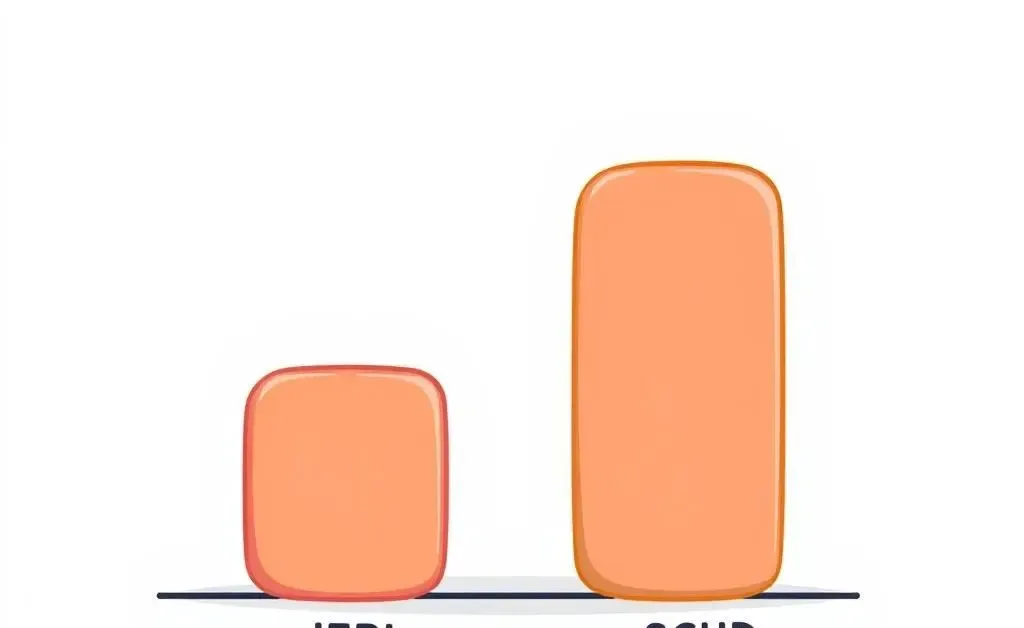

In the bustling world of the stock market, both JEPI and SCHD stand out for their attractive dividends. JEPI, or the JPMorgan Equity Premium Income ETF, is especially alluring with its high monthly dividend. It looks like the ultimate cash generator, right? SCHD, the Schwab U.S. Dividend Equity ETF, might not offer monthly payments but aims for a more comprehensive growth curve.

Considerations: What to Look For?

With JEPI, you're probably drawn to its consistent monthly payments. It’s like getting a regular paycheck, a comforting thought for stability seekers. This makes it perfect for those who long for that monthly financial boost.

On the other hand, SCHD offers a broader grow-over-time strategy. Though it won't stuff your pockets every month, its long-term growth potential is appealing. It’s like planting a tree and watching it provide a hefty shade as the years go by.

No Jargon, Just Practical Advice

Think of it this way: JEPI is the short sprint – thrilling and rewarding quickly, while SCHD is more of a marathon – requiring patience but potentially rewarding in strides.

Here's a small table to help visualize:

| Criteria | JEPI | SCHD |

|---|---|---|

| Dividend Frequency | Monthly | Quarterly |

| Growth Focus | Income | Growth + Income |

What’s Your Game Plan?

Choosing between JEPI and SCHD boils down to your personal financial goals. Need cash flow now? JEPI might be your match. Aligning for future dividends and growth? SCHD could be your ticket.

Conclusion: Your Investment, Your Journey

Ultimately, there is no one-size-fits-all answer here. It's crucial to align your choice with your personal objectives. Reflect on what resonates more with you and your financial landscape.

Remember, it’s all about finding the investment that makes you sleep peacefully at night. What’s your experience or thoughts on this financial needle in a haystack? I’d love to hear about your perspective on mastering dividends.