Lazy Investing: A Stress-Free Approach to Building Wealth

Discover the simplicity and benefits of lazy investing for a worry-free financial future.

Have you ever felt overwhelmed by the myriad of investment tips and strategies out there? You're definitely not alone! Many of us are searching for a way to grow wealth without becoming full-time Wall Street analysts. Enter lazy investing, the low-key approach to building wealth that lets you focus on living your life as money works for you.

What is Lazy Investing?

Lazy investing isn't about slacking off. It's a strategic method of investing that minimizes hands-on management and embraces simplicity. By relying on diversified, low-cost index funds or ETFs, you can build a portfolio that mirrors market performance, letting the compounding work its magic over time.

Why Choose Lazy Investing?

Let's face it; life can get busy. Lazy investing is perfect for those who want to start building their financial future with minimal time commitment. Here are some benefits:

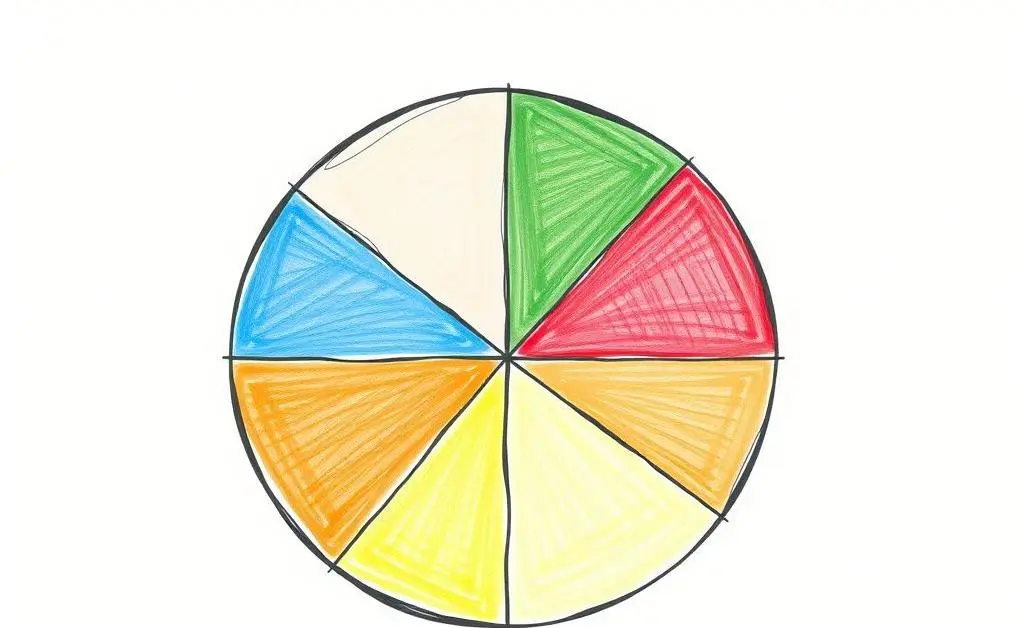

- Access to Diversification: By investing in index funds, you automatically diversify your portfolio across various sectors.

- Cost-Effective: Low expense ratios mean you keep more of your returns.

- Stress-Free: Enjoy peace of mind with a long-term strategy that doesn't require constant monitoring.

Here's a relatable anecdote for you: Imagine having a Saturday brunch with friends without the anxiety of the stock market looming in the back of your mind. That's the beauty of lazy investing — your portfolio thrives in the background while you live your best life.

How to Get Started

Starting to invest lazily isn't as daunting as it sounds. Here's a simple plan to ease you in:

- Define Your Goals: Consider what you want to achieve financially. Retirement, a dream home, or both?

- Select Your Investments: Choose broad-market index funds or ETFs that reflect your risk tolerance.

- Set Up Automatic Contributions: Automate your monthly investments to stay consistent.

- Review Annually: Once a year, check if your portfolio needs adjusting. Otherwise, let it ride!

Common Misconceptions

One of the biggest misconceptions is that lazy investing is boring. In reality, it provides the freedom and flexibility to enjoy life's adventures without the constant worry of fluctuating markets.

Potential Challenges

Of course, like any strategy, lazy investing isn't without challenges. Patience is key; the temptation to tinker with your portfolio during volatile periods can be strong, but staying the course usually pays off in the long run.

In conclusion, lazy investing allows you to focus on what truly matters while confidently securing your financial future. Remember, investing should be a means to an end, not the end itself. What are your thoughts on adopting a lazy investment strategy? Have you tried it, or would you consider it?