Making the Most of Your Savings: A Friendly Guide

Discover simple steps to optimize your savings for a brighter future.

Hey there! Let's talk savings, shall we? It's one of those important topics that everyone thinks about but doesn’t always feel confident acting on. But worry not—I'm here to share some friendly advice on how you can make the most of your hard-earned savings to secure a brighter future.

Why Focus on Savings?

First things first, why should we focus on savings? Well, having a solid savings plan is like having a safety net. It gives you the freedom to pursue opportunities, handle emergencies, and work towards bigger dreams without the stress of financial uncertainty looming over you.

Setting Up a Savings Routine

Creating a savings routine is simpler than it sounds. It all starts with understanding your income and expenses. Once you have a clear picture, you can set realistic savings goals. These could be anything from building an emergency fund to saving for a vacation. Remember, small, consistent contributions are more effective than one-off, large deposits.

Choosing the Right Savings Account

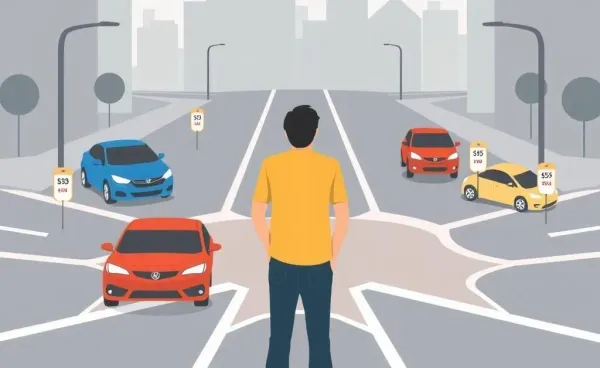

Not all savings accounts are created equal. Depending on your goals, you might want different features. For instance, if accessibility is key, a regular savings account might work best. But if you're saving for the long-term and won’t need immediate access, a high-yield savings account could let your money grow faster.

Thinking About Investments

Once your savings are in place, it might be time to think about investments. Investing can be an excellent way to multiply your savings, although it comes with its own risks. Explore options like stocks, bonds, or mutual funds. Each has different advantages, so it’s worth researching which aligns best with your comfort level and goals.

Balancing Safety and Growth

A key part of financial planning is balancing safety and growth. While it's nice to have secure funds, a bit of calculated risk can lead to more significant growth. Think about dividing your savings between safe and speculative ventures.

Planning for the Future

Dream a little! Think about where you want to be in 5, 10, or even 20 years. Your savings plan can be a roadmap to getting there. Whether it's home ownership, retirement, or travel, visualizing your goals can help you stay motivated.

As we wrap up this conversation about savings, remember, it’s about starting where you are and moving forward with intention. It's your personal journey, and every small step counts. I hope this guide has given you some clarity and inspiration to take control of your financial path.

Have fun with it, keep learning, and watch your efforts blossom over time. Until next time, happy saving!