Market vs. Limit Orders: Navigating Your Investment Strategy

Understanding market and limit orders can boost your investment game. Learn which suits your strategy.

Have you ever wondered about the best way to place your stock orders in the market? Understanding your options like market orders and limit orders can play a significant role in shaping your investment strategy. Let's dive into what they are, how they work, and which might suit you better.

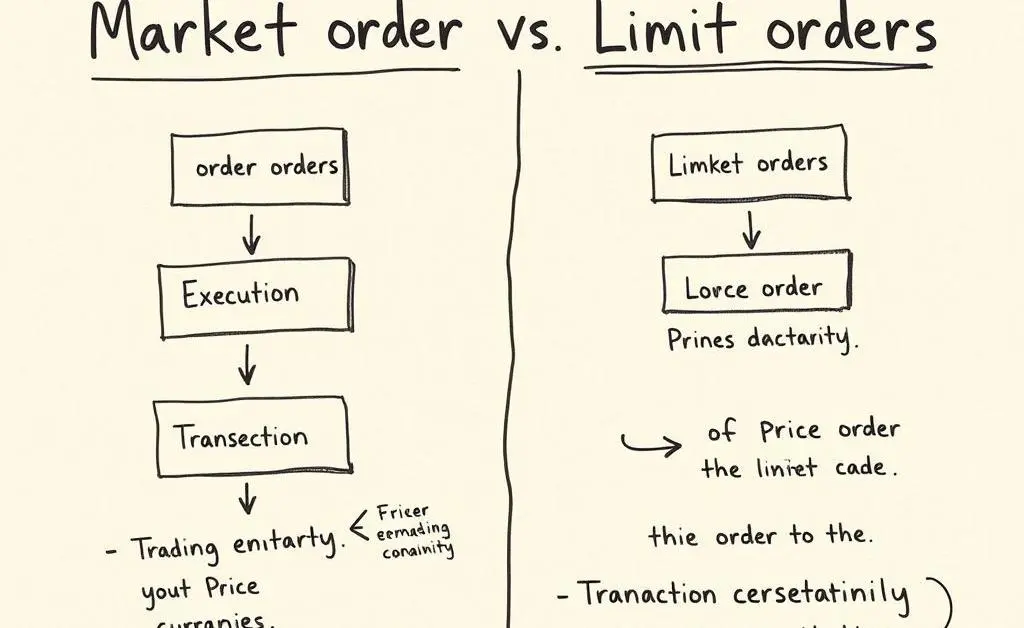

What's the Difference?

In the world of stock trading, knowing how to place an order can make a big difference. Here's a quick breakdown:

- Market Orders: These are fast and aim to purchase or sell a stock immediately at the best available price. Quick execution is the name of the game here, but prices can vary depending on market activity.

- Limit Orders: These allow you to specify a particular price at which you're willing to buy or sell. They don't guarantee execution, but they give you control over your transaction price.

Choosing the Right Order Type

Imagine you're planning to buy your favorite stock — let's call it Unicorn Inc. You want it quickly before an anticipated surge, so you opt for a market order to ensure a fast transaction, even if the price isn't locked in. Alternatively, if you're patient and want to buy Unicorn Inc. only when it drops to $50, a limit order is your best friend.

Pros and Cons

Both order types come with their own sets of pros and cons, it's crucial to evaluate:

- Market Orders: Ensure fast execution but not always favorable pricing.

- Limit Orders: Provide pricing precision but no execution guarantee.

Each investor's strategy is unique, and choosing the right order type depends on your goals and risk tolerance.

Where Do You Stand?

Think about what your investment style is telling you. Are you the go-getter who needs speedy transactions, or the patient strategist ready to wait for the right price?

In the Real World

Consider Jane, who invests part-time while working her 9-to-5. She prefers certainty and uses market orders for simplicity, accepting the potential for slight price variations. Meanwhile, her friend Alex, an active day trader, thrives on precision using limit orders to hit exact price points, though he sometimes misses out if the market doesn't come to his terms.

What's Your Next Step?

Understanding these order types is just the beginning. Dive deeper into your personal investment goals and risk levels. As always, investing involves risks, so a well-thought-out strategy is key to success. What's your next move in optimizing your investment strategy?