Mastering Credit Cards: A Journey to Financial Confidence

Learn how to use credit cards wisely for financial growth and confidence.

You know, mastering credit cards is a bit like mastering a new recipe. It can be intimidating at first, but with a little practice, it becomes second nature, potentially unlocking flavors you didn't even know were there. Today, I want to share some insights I've gathered over time on using credit cards not just as a financial safety net, but as a tool for growth and confidence.

Why Credit Cards? Understanding Their Potential

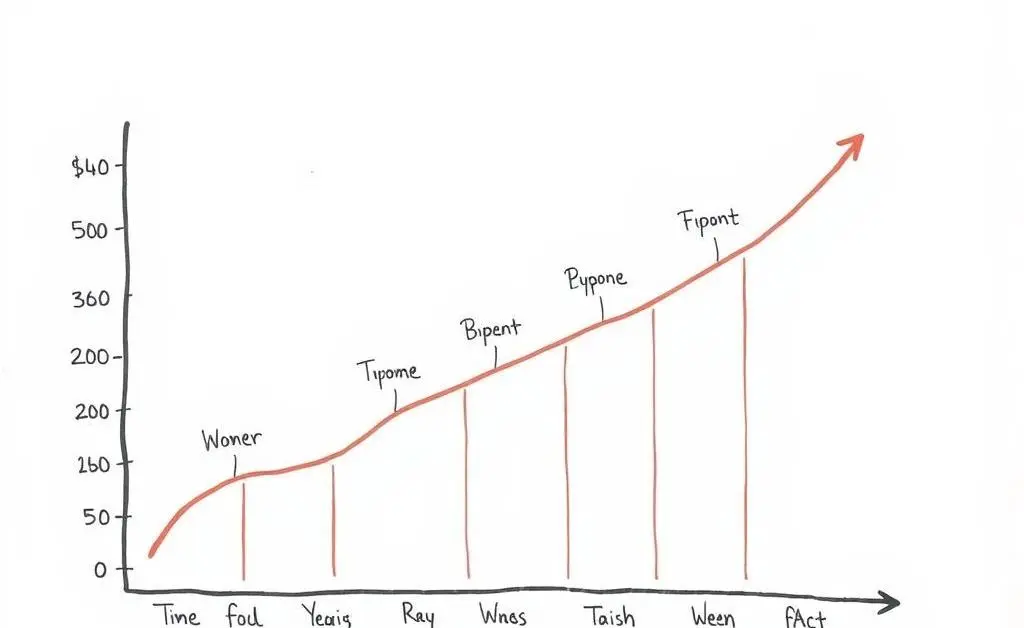

At their core, credit cards can offer impressive benefits if used wisely. They’re more than just convenient payment tools; they can actually help in building your credit score—a crucial financial milestone that ripples into many areas of your life.

When managed effectively, credit cards open doors to better loan terms, lower interest rates, and yes, dreamy travel rewards. They act like a financial Swiss Army knife, enhancing your purchasing power and providing mechanisms for future possibilities.

Getting Started: Building a Healthy Credit Relationship

Starting on the right foot is crucial. Here’s how:

- Understand Your Credit Limit: It’s not extra cash; it’s borrowed money that you’ll need to repay—preferably in full.

- Timely Payments: Set reminders or automate your payments. This practice builds trust and steadily elevates your credit score.

- Mindful Spending: Keep track of expenses and make sure they align with your budget. Avoid impulsive purchases that lead to high balances.

The Art of Budgeting with Credit Cards

Incorporating credit cards into budgeting can be creatively empowering. Imagine a cozy evening with a warm cup of tea, candles lit, planning next month's finances. It’s not just about numbers, but rather setting intentions for how you wish to grow financially—in a calm, assured manner.

Establish a budget that incorporates both your income and your monthly credit card expenses. This dynamic planning can help prioritize spending on things that truly matter, while also enhancing your financial stability.

Building Confidence in Your Financial Choices

Confidence in handling credit cards comes with time and consistent effort. Engage in small, manageable steps that foster growth at your own pace. Perhaps it’s about paying off the entire balance rather than just the minimum, or maybe it’s being strategic about when and what to charge. Your goal is to see your credit card not as a burden, but as a wing that helps you soar towards your financial dreams.

The beauty of mastering credit cards lies not just in increased credit scores but in the personal satisfaction of financial achievements, however small they may seem.

Reflect and Take Charge

As you embark on this journey, remember that every financial decision is a step towards a broader understanding of finance, both emotionally and strategically. How you use credit cards can be a reflection of how you wish to shape your life—fostering confidence, responsibility, and a window to new ventures. So, dear friend, let’s embrace this financial path with curiosity and courage. You’ve got this!