Mastering Financial Independence: Simple Steps to Build a Secure Future

Discover practical insights for financial independence with simple steps to manage your budget and secure your future.

Have you ever wondered what it truly means to be financially independent? It’s more than just having enough money to pay the bills each month. It’s about creating a life where you feel secure and free to pursue your passions without constantly worrying about money. Sounds dreamy, right? Let’s explore how you can make this dream a reality.

Why Start Planning for Financial Independence Now?

Many people kick the financial ball down the road, planning to figure things out later. But the truth is, the sooner you start planning, the more freedom you enjoy. Whether you’re looking to retire early or simply want more flexibility in your career, starting your journey now can have significant long-term benefits.

Where Should You Begin?

It all starts with understanding your current financial situation. Here’s what you should do:

- Create a budget: Track your income and expenses to see where your money goes each month.

- Set financial goals: Whether it's saving for a down payment or building a retirement fund, know what you're aiming for.

- Build an emergency fund: Have at least three to six months’ worth of expenses saved in case of unexpected events.

Investing for Your Future

Once your immediate financial house is in order, it’s time to think about investing. Don’t worry; you don’t need a finance degree to get started! Consider options like low-cost index funds, which offer diversification and a solid return over time.

If you’re new to investing, this site is a great resource to help you understand the basics without overwhelming jargon.

The Power of Consistency

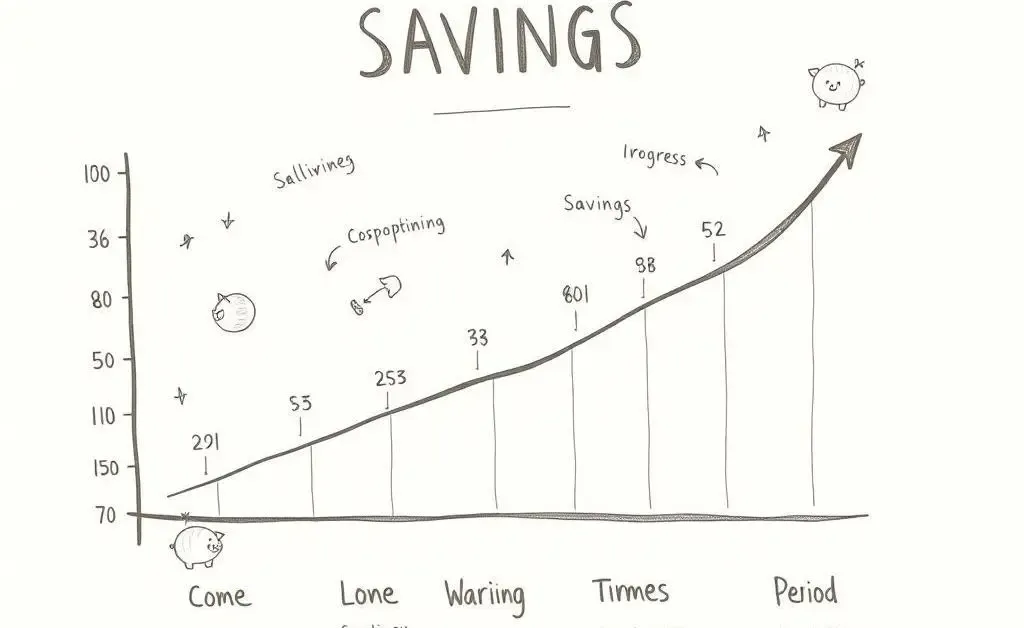

Here’s a secret: consistency is key. Regularly contributing to your savings and investment accounts, even in small amounts, can compound over time, growing into substantial wealth.

Making Adjustments Along the Way

As life changes, so should your financial plans. Don't be afraid to revise your goals and budgets to fit your current circumstances. Flexibility is crucial for long-term success.

Are You Ready to Take Control?

Building a financially independent future doesn’t happen overnight, but by starting today and staying the course, you can achieve the freedom you desire. So, what’s your first step towards financial independence today?