Mastering Mortgage Payments: Understanding Principal and Interest

Unravel the mystery of mortgage payments and learn how to optimize your finances effectively.

Mastering Mortgage Payments: Understanding Principal and Interest

When you sign up for a mortgage, do you find yourself staring blankly at the terms, all the while wondering if you've just pledged your soul in some overly complicated financial contract? You're not alone. For many, understanding the intricacies of mortgage payments, especially the distinction between principal and interest, can feel like trying to solve a Rubik's cube blindfolded.

Breaking Down Your Monthly Mortgage Payments

Let’s start by dissecting each mortgage payment. Imagine each amount paid consists of two main parts: the principal and the interest. The principal is essentially the original amount of money you borrowed to buy your house. Paying down the principal is directly reducing the amount you owe, while the interest is the bank's profit for lending you the money.

Why Does It Seem Like You’re Not Making a Dent Initially?

Here's the twist: Typically, at the start of your mortgage, a larger portion of your payment goes toward interest rather than principal. This phenomenon occurs because interest is calculated based on the current loan balance. So initially, with a higher balance, the interest portion is also higher. Sounds like a catch, right?

Amortization to the Rescue

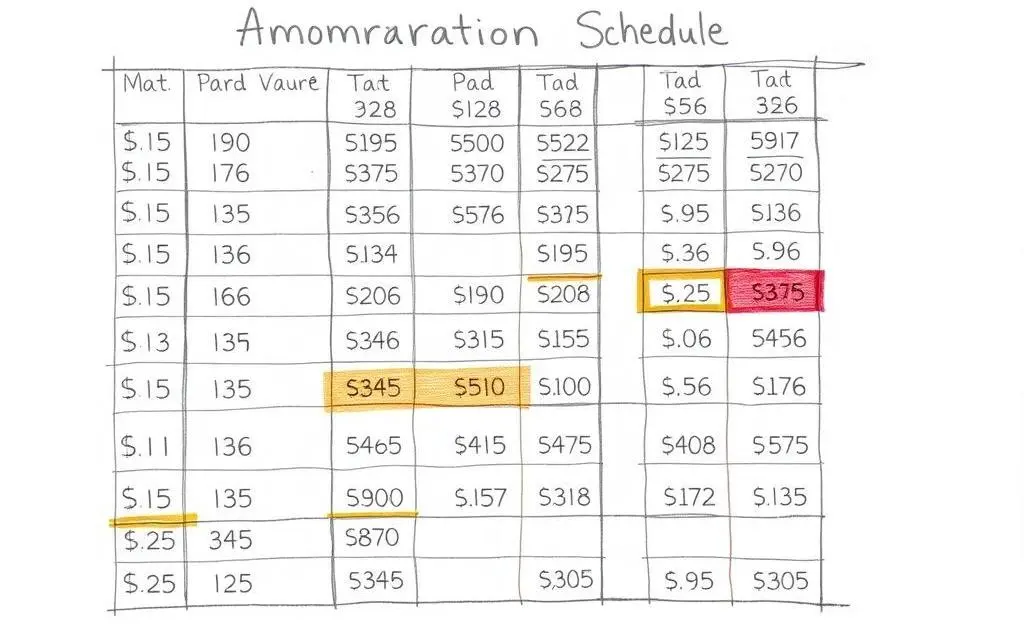

The solution to understanding this is called amortization. It’s a rather fancy term for a simple concept: a gradual repayment plan where payments over time slowly shift more toward reducing the principal and less toward interest.

Why Focus on Paying Down Principal?

- Reduce Your Overall Interest: The less principal you owe, the less interest you'll pay over time.

- Build Home Equity: More principal paid equals more equity in your home, which can be leveraged for other financial ventures.

- Financial Security: Paying down your mortgage sooner gives you more financial flexibility for the future.

It’s useful to periodically review your payments. Being proactive, such as making additional payments towards the principal, can significantly cut down the total interest paid and reduce loan length.

How to Optimize Your Mortgage Game Plan

Here are a couple of tips:

- Bi-weekly Payments: Instead of monthly payments, opt for a bi-weekly schedule. You'll make one extra payment per year, shaving years off your loan term and saving tons of interest.

- Extra Lump Sum Payments: Got a tax refund or bonus? Consider putting it towards your principal.

At the end of the day, having a clear understanding of how your mortgage payments work enables you to make informed decisions. Knowledge is power, and with it, you’ll feel like you’ve got the financial superpowers needed to conquer your mortgage fears. What strategies are you considering for tackling your mortgage?