Mastering Multiple Loans: A Friendly Guide to Smart Borrowing

Discover how to navigate multiple bank loans without stress! Practical tips inside.

I often find myself in conversations where people are wondering if it's really okay to have more than one bank loan at the same time. The short answer? Yes, it's possible, but there are a few things to consider before you start signing on those dotted lines.

Why Consider Multiple Loans?

There are several reasons you might want to take out multiple loans. Perhaps, you need to fund a home renovation while also covering education costs. It’s not uncommon!

However, the primary keyword to remember is responsibility. While handling multiple loans can be a savvy financial strategy, it can also lead to stress if not managed carefully.

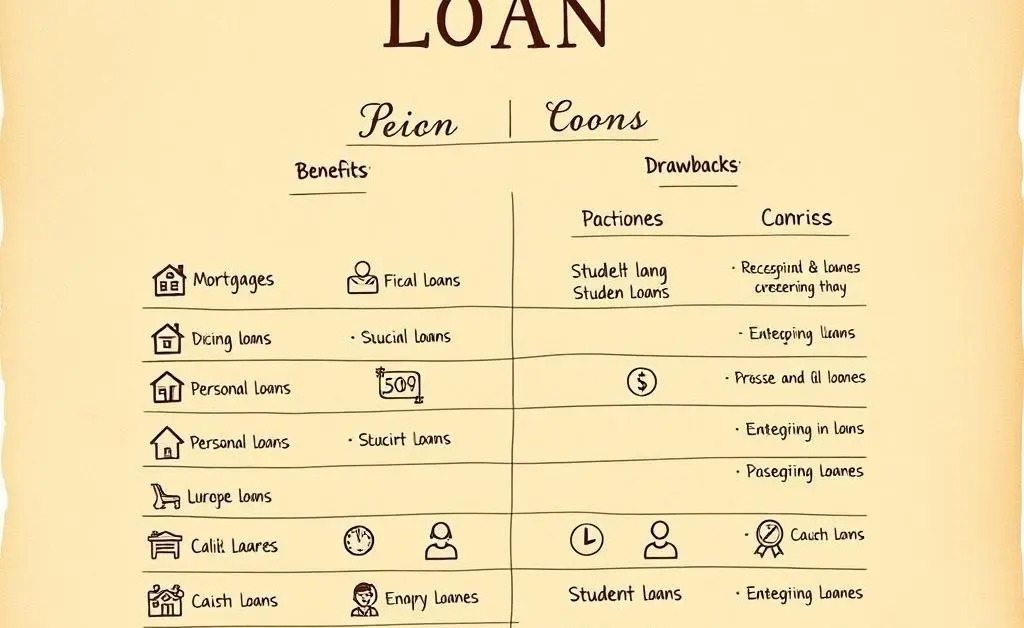

The Benefits of Multiple Loans

- Flexibility: Multiple loans can provide flexibility in managing different financial aspects of your life simultaneously.

- Credit Building: Successfully managing multiple loans can help you build a strong credit history.

Things to Watch Out For

On the flip side, there are some pitfalls you should be aware of.

- Interest Rates: Each loan comes with its own interest rate. It's essential to ensure you're getting competitive rates across the board.

- Debt-to-Income Ratio: Lenders will assess your ability to manage additional loans based on your existing income and debts.

A great tool to help you manage loans is a simple budget calculator. It helps estimate your monthly payments and can prevent common debt pitfalls.

How to Strategically Manage Multiple Loans

Managing more than one loan doesn’t have to be daunting. Here are a few practices to keep everything under control:

Create a Simple Budget

Sit down with a coffee and jot down all your monthly expenses, including your loan payments. This can give you peace of mind knowing exactly where you stand financially.

Consolidate Where Possible

Sometimes, consolidating high-interest loans into a single, lower-interest one can save you money and hassle.

Final Thoughts

In conclusion, while juggling loans might sound like a balancing act, with the right management strategies, it’s entirely doable. Take the time to step back, review your financial picture, and plan accordingly. Remember, borrowing doesn't have to be a burden; it can be a bridge to your financial goals.

Have you managed multiple loans before? How did you ensure they didn't become overwhelming?